BASF announced on June 25 that it will no longer further assess the potential investment in the nickel-cobalt refinery in Weda Bay, Indonesia.

BASF signed a cooperation investment agreement worth 2.4 billion euros with the global mining and metallurgical group Eramet in 2020, and jointly evaluated the investment potential of the project. The two parties originally planned to start production of the nickel-cobalt refinery using high-pressure acid leaching (HPAL) technology in 2026, with an annual designed capacity of 67,000 tons of nickel and 7,000 tons of cobalt.

Abundant nickel supply in the market may be one of the reasons for terminating this investment project. According to Anup Kothari, Managing Director of BASF Europe, this is a conclusion drawn after thorough assessment, and the nickel-cobalt refining project will not proceed in Weda Bay. Significant changes have occurred in the global nickel market since the project was initiated. In particular, the options for suppliers have changed, and BASF has more choices for nickel suppliers for battery-grade nickel. Therefore, BASF believes there is no need to make such a large-scale investment to ensure the supply of battery materials. The company will stop all ongoing assessments and negotiations for the project in Weda Bay, Indonesia.

Although BASF does not plan to build a nickel refinery in Indonesia, it does not intend to give up on the procurement of nickel from Indonesia. Dr. Daniel Schönfelder, President of BASF's Catalysts Division, said: "Key raw materials for the safe, responsible, and sustainable supply of precursors for nickel-cobalt-manganese (NCM) cathodes - which may also come from Indonesia - remain crucial for the future development of our battery materials business. BASF's battery materials business division has a dedicated procurement team focused on the management and trade of metals and precursors, and has established a strong network of partners to ensure the supply flexibility needed for the growing global cathode active material business."

Eramet also issued a brief statement, saying "After thorough evaluation, including discussions on the project's execution strategy, both parties have decided against this investment." Eramet mainly produces metals such as nickel and manganese, has multiple mineral resources in Argentina and Indonesia, and is also one of the first companies to invest in nickel mines in Indonesia.

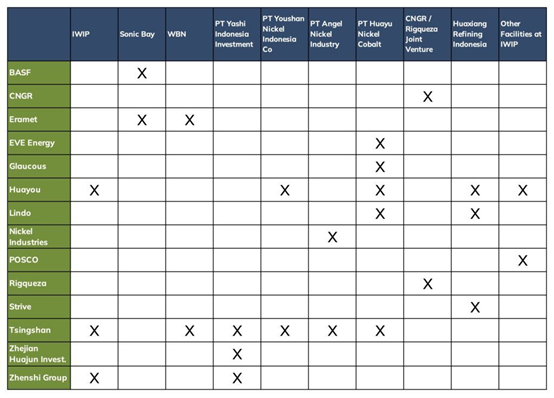

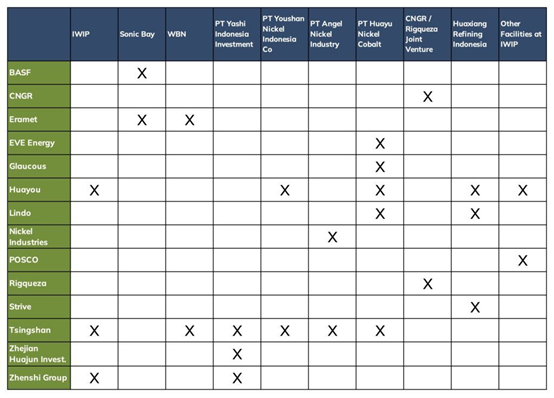

According to an investigative report on the Indonesian nickel industry titled "Nickel Unearthed: The Human and Climate Costs of Indonesia's Nickel Industry," released in January this year by the international human rights organization Climate Rights International (CRI), Indonesia is the world's largest nickel producer, supplying 48% of global nickel demand in 2022. The report conducted detailed human rights and environmental due diligence on several Chinese-funded nickel refining enterprises in the large nickel industrial park IWIP (Indonesia Weda Bay Industrial Park) such as Tsingshan Holding, as well as BASF and Eramet, POSCO of South Korea, and car companies like Tesla, Ford, and Volkswagen that have signed contracts to purchase nickel from Indonesia. It is uncertain whether this report has had some impact on the investment decisions of BASF and Eramet in Indonesia.

CRI: Companies investing in Indonesian nickel mines

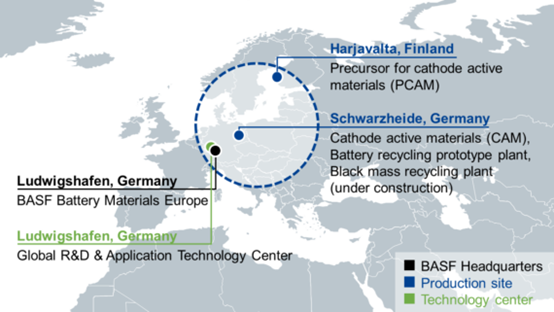

BASF is also focusing more on battery recycling. Recently (June 18), BASF signed a battery recycling cooperation agreement with the Slovak battery recycling company WHW Recycling. From the end of this year, cathode and anode foil waste from battery production will be processed and separated at WHW's two new separation plants in Baudenbach, Germany, and BASF will then purify the obtained cathode active materials for reuse. BASF has previously cooperated with Eramet and SUEZ in the field of battery recycling.

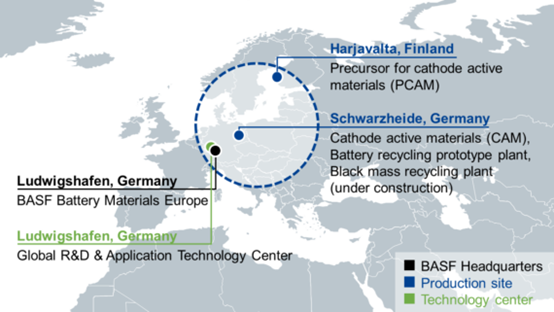

BASF lithium-ion battery materials facilities in Europe

In April this year, BASF also closed its precursor cathode active material factory in Harjavalta, Finland, probably due to lack of support from the local government, and the permits obtained were questioned and revoked by the Finnish government. The refinery originally belonged to the Russian mining group Norilsk Nickel. The Finnish precursor factory was originally planned to supply BASF's cathode active material factory in Schwarzheide, Germany, with an annual capacity of 40,000 tons.