According to the recent report from Reuters, lithium mines operated by Chinese companies will continue to inject funds to maintain normal operations, rather than reducing production on a large scale due to low lithium salt prices. The media stated that the continued production of lithium salts is a boon for battery manufacturers but also noted that this move would increase oversupply and prolong weak prices in the lithium market.

So far, about a dozen lithium producers have temporarily closed loss-making mines, reduced output, or postponed expansions. However, many mines continue to operate to maintain market share and good relations with governments, as closures and restarts can cause technical issues. "About 10% of production is at a loss," said analysts interviewed by Reuters.

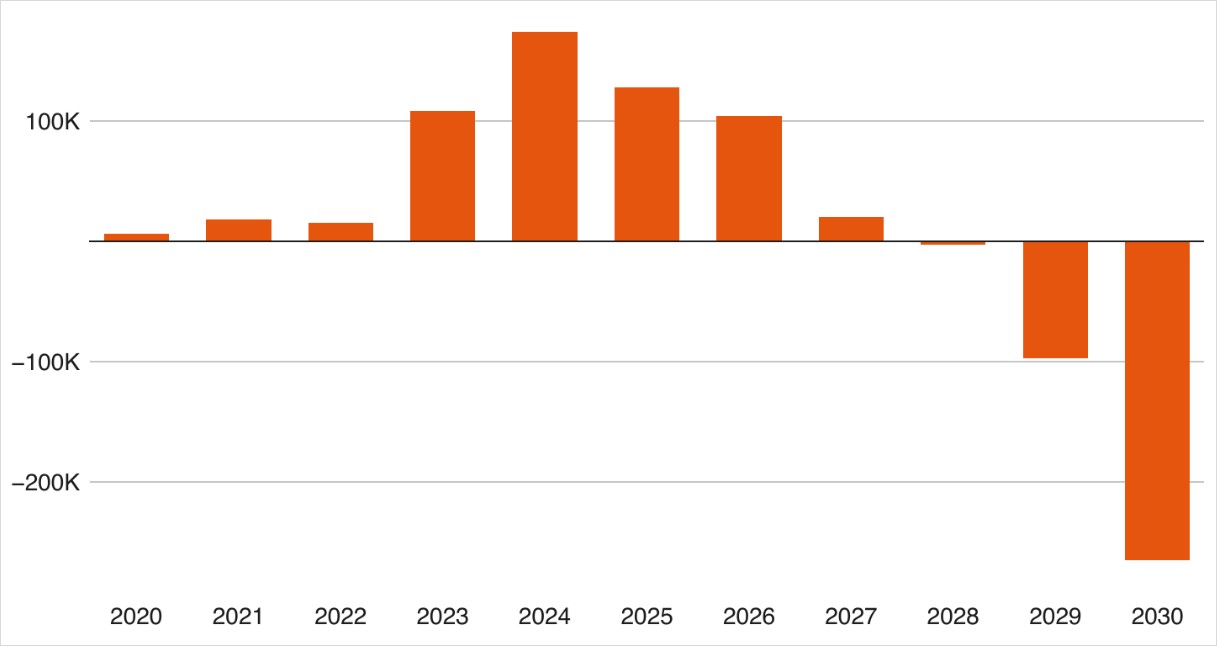

UBS stated that it expects global lithium supply to increase by 25% this year and by 15% in 2025. This means that the global supply glut of lithium needed for energy storage and electric vehicles is likely to last for several years and maintain low prices. According to UBS's latest forecast, the lithium surplus is expected to last until 2027.

Source: UBS; Unit: LCE

The price of lithium hydroxide has fallen nearly 90% since reaching a peak of $85 per kilogram in December 2022, after soaring more than sevenfold over the previous 18 months.

Reuters noted that lithium mines being operated by Chinese minders located in China, Australia, and Africa have been integrated into downstream supply chains and are unlikely to close. Stable and low-cost raw material supplies can maintain China's leading position in the electric vehicle and lithium-ion battery industries.

The surge in electric vehicle sales expectations and the skyrocketing lithium prices in 2021-2022 stimulated investment in lithium mines and the opening of new mines. Global investment in lithium mines increased by 60% in 2023, with China's investment in Zimbabwe being part of this. Zimbabwe has now become the world's fourth-largest lithium mining country.

According to Cameron Perks, Director of Lithium Products at Benchmark in the UK, all four operating mines in Zimbabwe are controlled by Chinese companies but have low profits or even losses, with costs ranging from $600 to $1000 per metric ton of material, while the price is $765 per ton. Reuters pointed out that the highest-cost mine in Zimbabwe, Arcadia, owned by Huayou Cobalt, is among them.

Maintaining these mines is also due to geopolitical considerations: supply chains in Australia and Canada are not stable for China and have encountered some resistance.

For the higher-cost Australian mining industry, some companies plan to continue operating with the support of battery manufacturers, readjusting mining plans, and offsetting losses from lithium production with profitable production of iron ore, copper, or nickel.

Australian mining company MinRes last month stated that it was putting its Bald Hill mine under maintenance; the company's other two mines, including Mt. Marion, are also in production. Mt. Marion mine has higher production costs than Bald Hill mine due to lower grades. Ganfeng Lithium holds a 50% stake in Mt. Marion mine, and the mine's significant income comes from the mining contract with Ganfeng Lithium.

Another Australian mining company, Liontown Resources, has kept its new Kathleen Valley mine in operation by reducing output during its ramp-up period. Liontown reported an annual net loss after tax of AUD 64.9 million, but the company has been supported by South Korean battery manufacturer LG Energy Solution (LGES), which provided $250 million in funding in July and signed a 10-year extension (totaling 15 years) lithium supply agreement with Liontown.