According to an announcement made on Tuesday, September 4, by the Australian-listed Black Rock Mining Ltd. ("Black Rock") (ASX: BKT), South Korea's leading steel and battery materials conglomerate, POSCO Group, has agreed to acquire a 19.9% stake in Black Rock Mining Ltd. for $40 million.

Black Rock, the world's second-largest natural graphite miner, is currently developing the Mahenge graphite project in Tanzania. The Australian mining company holds an 84% stake in the operating entity of the Mahenge graphite project, Faru Graphite Corporation, with estimated reserves of about 6 million tons of natural graphite. The remaining 16% of the Mahenge project is owned by the Tanzanian government.

The Mahenge graphite project is scheduled to commence production in 2026 with an annual capacity of 89,000 tons, with plans to expand to 347,000 tons in the future.

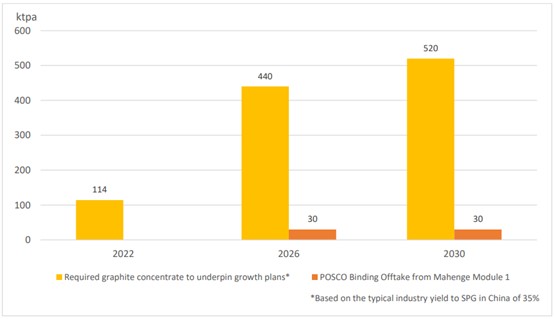

Under this memorandum of understanding signed by POSCO and Black Rock, POSCO International's investment in Black Rock will be used for the construction of Module 1 of the Mahenge graphite mine. It will also secure the purchase of additional 30,000 tons of natural graphite annually from Module 2 of the Mahenge project, with the offtake contract term of 12 years and an optional extension of another 15 years.

Previously, in May 2023, POSCO International had already signed a cooperation agreement with the mine, investing $10 million to take a share in the first phase of the graphite mine and signing a 25-year offtake agreement to purchase the same amount of 30,000 tons of natural graphite annually from 2026, totaling 750,000 tons of graphite concentrate. Subsequently, on September 4, 2023, POSCO International signed a memorandum of understanding with Black Rock and its controlled Faru Graphite Corporation for joint investment in Module 2 of Faru, increasing its annual purchase volume of natural graphite concentrate to 60,000 tons.

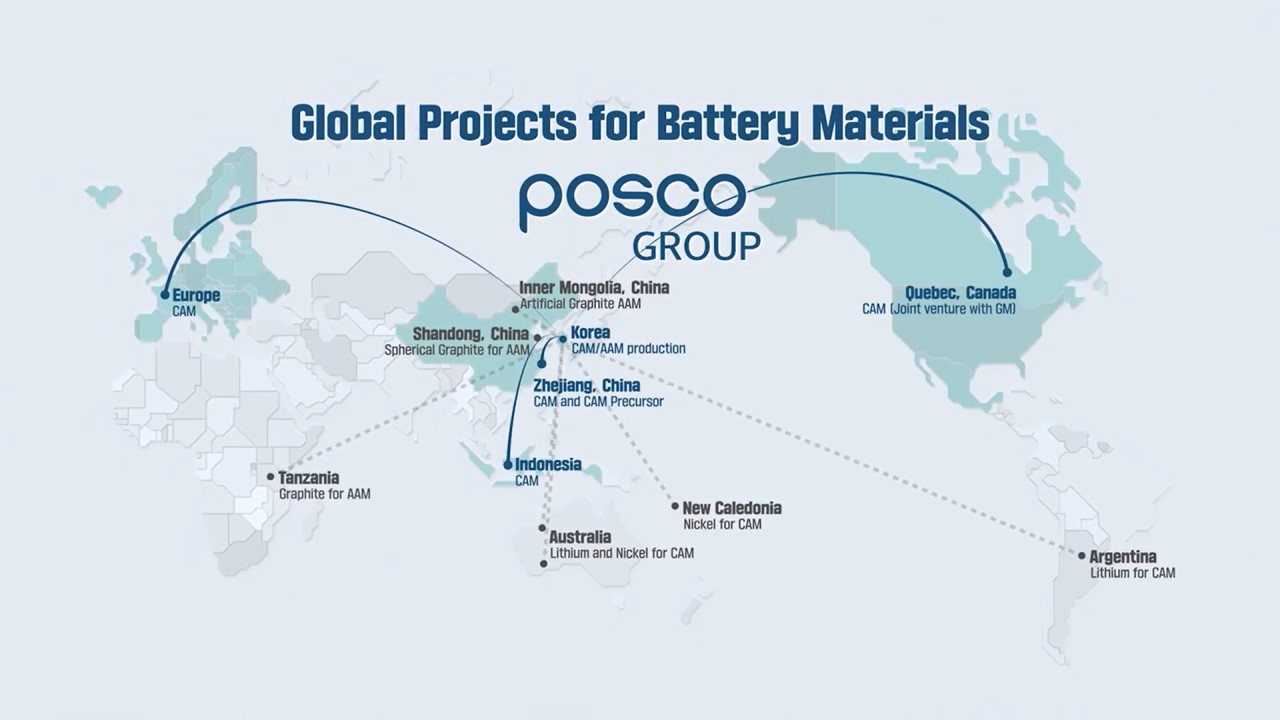

POSCO Holdings Inc. the parent company of POSCO Future M, is the only anode producer in South Korea, is currently heavily dependent on Chinese raw materials, with about 90% of its graphite imports coming from China. The South Korean battery industry also has a close cooperative relationship with the United States, with major battery and electric vehicle companies such as Hyundai Motor Group, LGES, SK On, and Samsung SDI having a large amount of capacity investment in the United States. The Biden administration in the United States has introduced the IRA bill and FEOC rules aimed at isolating China's battery industry chain and plans to stop providing tax deductions for battery materials containing Chinese graphite from 2027. In addition, China has export restrictions on key minerals such as graphite. POSCO Group is thus implementing a diversified supply of key battery materials such as lithium, cobalt, nickel, and graphite, in order to reduce dependence on Chinese raw materials and enhance the global competitiveness of South Korea's battery industry.

In terms of diversifying and increasing graphite supply, POSCO Group has begun to invest in mining projects across Africa. In addition to the aforementioned Tanzanian graphite mine, it has also laid out graphite mines in Mozambique and Madagascar, and is increasing the production of artificial graphite in South Korea as well.

On August 28, 2023, POSCO International and Canadian mining company NextSource signed a memorandum of understanding for joint investment in NextSource's Molo graphite mine, one of the largest graphite reserves in Madagascar. POSCO International is expected to secure about 30,000 tons of natural graphite concentrate and about 15,000 tons of spherical graphite annually for the next ten years. The Molo mine is estimated to have reserves of about 22 million tons of graphite.

In March 2024, according to the announcement of Australian Syrah Resources Ltd., POSCO Future M will import up to 60,000 tons of natural graphite concentrate annually from Syrah Resources Ltd.'s Balama graphite mine in Mozambique for six years, which is enough to support the production of about 30,000 tons of natural graphite anode materials annually.

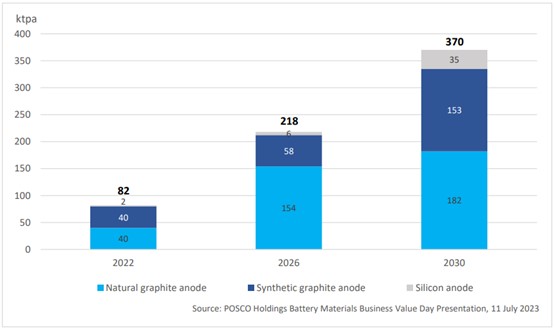

According to data released by POSCO Future M in September 2023, POSCO Future M plans to increase its anode business from 82,000 tons in 2022 to 370,000 tons by 2030. By 2027, the company's graphite material output will reach 120,000-270,000 tons annually, and the company stated that the current locked graphite concentrate supply can cover most of the company's graphite anode material production needs.

POSCO Future M's graphite material business growth plan

POSCO Future M's graphite concentrate business growth forecast

POSCO Holdings, a large South Korean steel group with a market value of over $32 billion, has a large and growing battery materials business. POSCO Holdings owns 60% of POSCO Future M (formerly POSCO Chemical), the main body of the group's battery materials business. POSCO Future M produces cathode and anode materials and is the largest anode material producer outside China. POSCO International, the largest trading company in South Korea, is 71% owned by POSCO Holdings and is responsible for securing raw materials for the group.

In addition, South Korea has established a 50 trillion won ($3.7 billion) fund through the Ministry of Trade, Industry, and Energy to provide financial support, including low-interest loans, to domestic battery material manufacturers such as POSCO Future M.