On October 23rd local time, Tesla released its financial report for the third quarter of 2024. Although the company's revenue was slightly below market expectations, its profits exceeded Wall Street's forecasts. Tesla expects a slight increase in deliveries this year, reflecting a rebound in market demand for its electric vehicles.

The financial report shows that Tesla's Q3 revenue was $25.18 billion, a year-on-year increase of 8%, slightly below market expectations; net profit was approximately $2.17 billion, a year-on-year increase of 17%, or $0.62 per share, significantly exceeding analyst expectations; the operating profit margin was 10.8%, higher than the 7.6% of the same period last year.

Revenue from Tesla's automotive business was $20.016 billion, a year-on-year increase of 2%; revenue from energy generation and storage was $2.376 billion, a year-on-year increase of 52%; service and other revenue was $2.79 billion, a year-on-year increase of 29%.

Tesla's significant profit increase is mainly due to the growth in vehicle deliveries and the sale of regulatory carbon credit. By selling carbon credit quotas to other automakers, Tesla made a pure profit of $739 million in the third quarter.

It is worth mentioning that the electric pickup Cybertruck achieved a positive gross margin for the first time. According to statistics from Cox in the United States, Tesla sold more than 16,000 Cybertrucks in the third quarter of this year, with a cumulative sales volume of more than 28,000 from January to September.

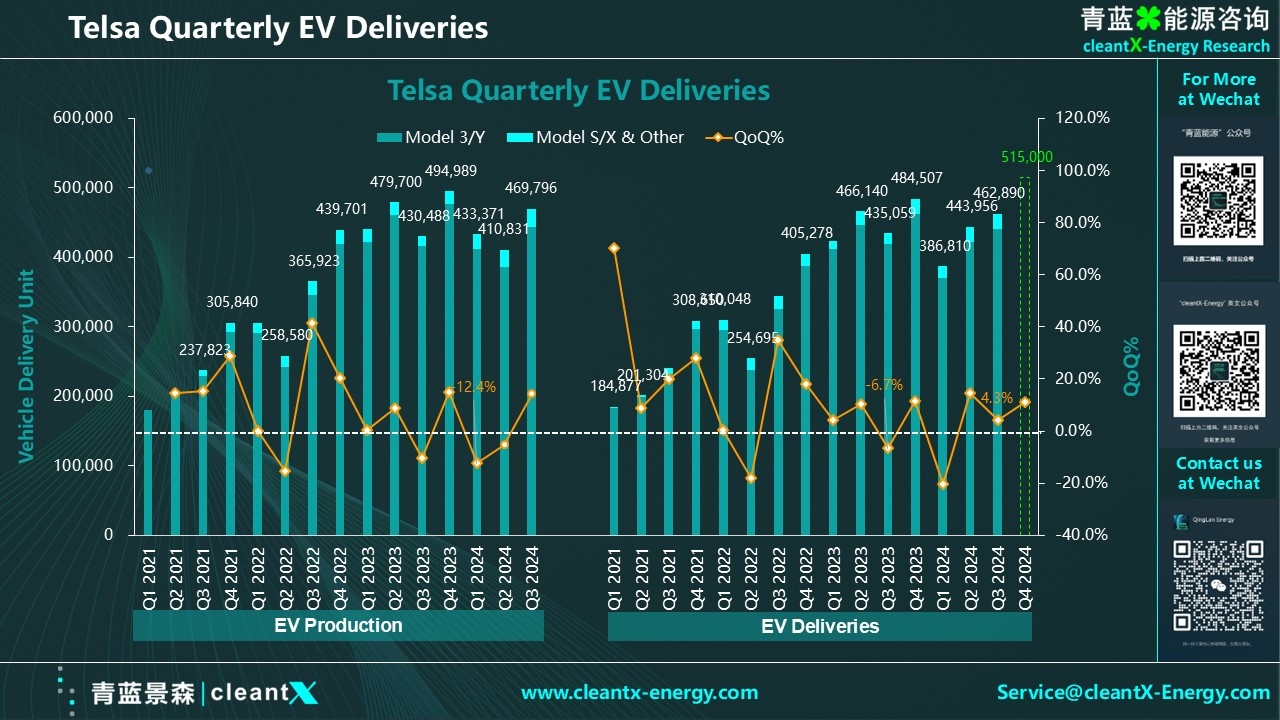

Following the strong delivery volume in the third quarter, Tesla expects the delivery volume to grow strongly in the current quarter, with an increase in annual deliveries. Tesla stated, "Despite the ongoing severe macroeconomic situation, we expect a slight increase in vehicle deliveries in 2024." Considering the slowdown in Tesla's delivery volume in the first half of this year, the company needs to significantly increase sales in the fourth quarter to catch up with or surpass last year's level.

Before Tesla's press conference, media analysts indicated that Tesla's delivery volume in the fourth quarter would be approximately 510,000 to 520,000 units. Tesla's vehicle delivery volume for this year should be able to be roughly equal to last year, and it is expected to increase to over 2 million units by 2025.

In a conference call following the release of the financial report, Tesla CEO Elon Musk stated that, thanks to reduced vehicle costs and the advent of autonomous driving, Tesla's vehicle sales could increase by 20%-30% under the best circumstances next year.

Furthermore, it is expected that the Robotaxi especially Cybercab will achieve mass production in 2026, with a target of producing at least 2 million units per year; the company plans to launch ride-hailing services (shared mobility services) in Texas and California in 2025, pending regulatory approval.

Following Tesla's Robotaxi event on October 10th, the usage rate of the company's Full Self-Driving (FSD) vehicles has increased. In addition, Tesla's 4680 battery has made positive progress by developing 4 versions of 4680 batteries for Cybertruck, Robotaxi and other EV models, and the 4680 battery is considered to be "the most competitive battery in the United States" in terms of cost. In the past two months, Tesla's existing suppliers, LG Energy Solution and Panasonic Energy, have also been planning to mass-produce the 4680 battery as soon as possible. LGES has recently signed a multi-billion dollar order for the 46 series large cylindrical batteries with Mercedes-Benz.