Please enter your registered phone number below to receive the verification code

The latest data from the Swedish transport market show that the country's car market has seen a decline in both May 2024 and the cumulative registrations for the first five months. Compared to the same period in 2023, the number of new registrations for passenger cars fell by 12%, heavy trucks by 14%, light trucks by 11%, and buses by 32%.

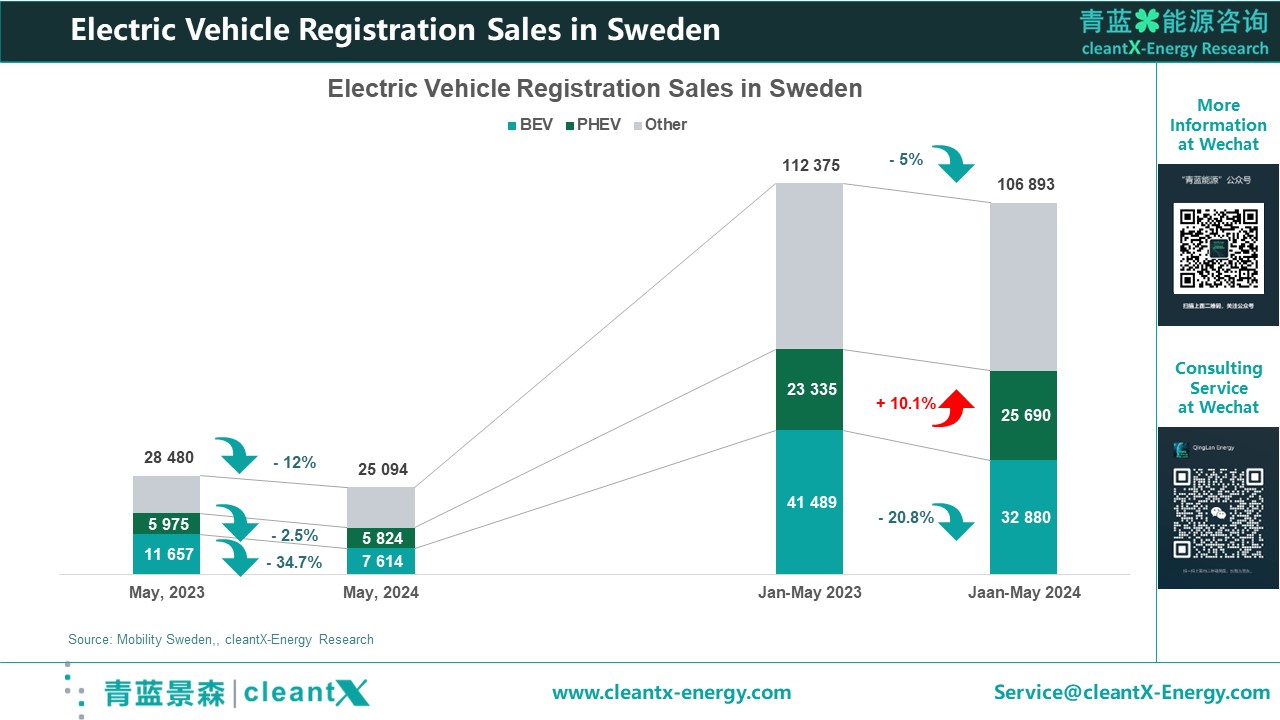

In May, the number of registered passenger cars in Sweden was 25,094, a decrease of nearly 12% year-on-year. Among them, the registration volume of pure electric vehicles (BEV) was 7,614 (year-on-year -34.7%), and the registration volume of plug-in hybrid electric vehicles (PHEV) was 5,824 (year-on-year -2.5%), together accounting for 53.5% of new vehicle registrations. Pure electric vehicles accounted for more than 30% of the new registrations for the month, a drop of 10 percentage points from around 41% last year. The share of plug-in hybrid electric vehicles increased again after a declining trend last year.

From January to May, the number of registered passenger cars in Sweden was 106,893, a decrease of 5% year-on-year. Among them, the registration volume of pure electric vehicles (BEV) was 32,880 (year-on-year -20.8%), and the registration volume of plug-in hybrid electric vehicles (PHEV) was 25,690 (year-on-year +10.1%), together accounting for 54.8% of new vehicle registrations, a decrease of 2.9 percentage points from the same period last year.

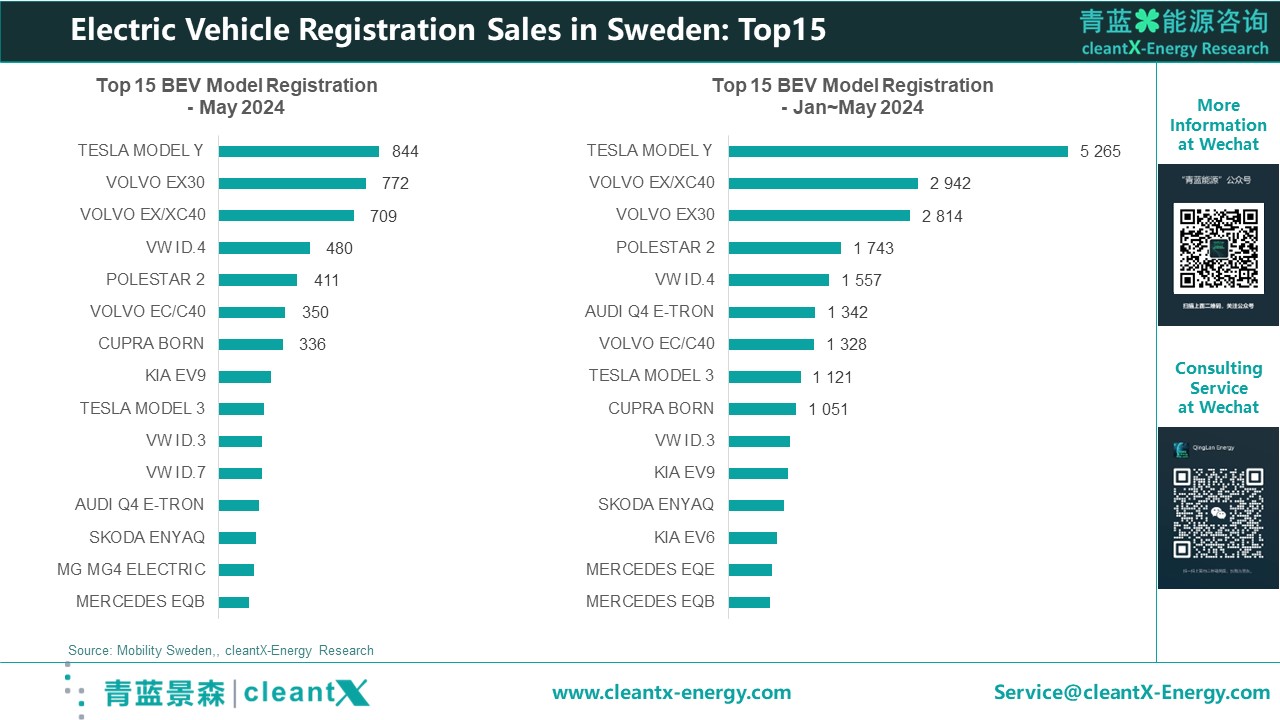

Tesla, Volvo, and other local European brands continue to dominate the Swedish electric vehicle market, with the Tesla Model Y being the best-selling model. Domestic brands or popular models such as MG ZS, Zeekr 001, BYD ATTO 3, XPeng P7, and NIO EL6 are also sold in Sweden, but except for the MG4, they have not yet entered the top 20 in terms of sales.

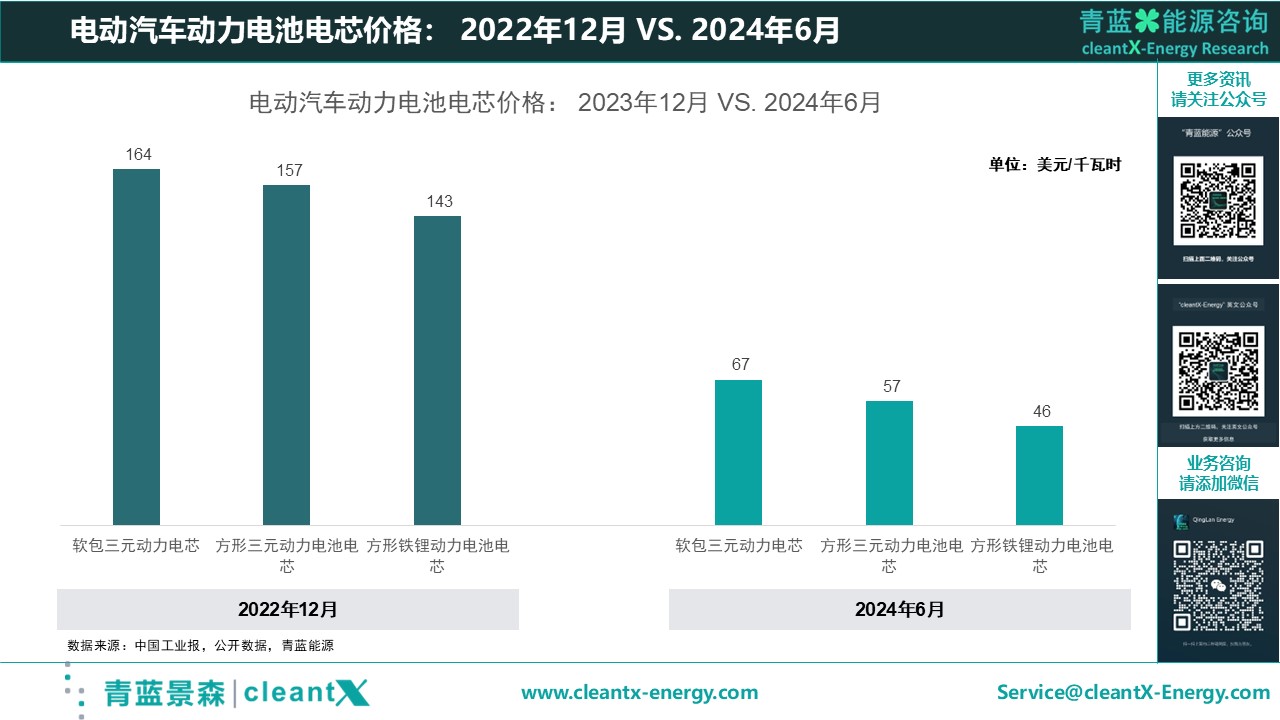

Market data shows that the strong growth rate of electric vehicles in Sweden in recent years has leveled off this year, and the competition in the future electric vehicle market in Sweden will focus more on cost-effectiveness. Compared with their fuel-powered counterparts, pure electric vehicles in Sweden are still overpriced, for example, the price of the Peugeot 208 BEV is more than double that of its internal combustion engine version. Due to the long-term economic tightening the country is experiencing, pure electric vehicles are susceptible to cuts in consumer budgets.

Sweden's charging infrastructure continues to expand rapidly, with 1,511 new charging piles and 160 charging stations added in May. 82% of the new charging piles are AC charging piles with less than 50kW. Despite the current rapid expansion of charging facilities, the market is concerned that if the ownership of electric vehicles does not grow at the corresponding rate, the expansion of public charging infrastructure will also slow down.

Sweden's economy grew by 0.7% in the first quarter after revision, which is the first positive growth after four consecutive quarters of negative growth. The country's CPI in April fell from 4.1% in March to 3.9%; the interest rate has been maintained at 4% for 7 consecutive months and was reduced to 3.75% in May; the PMI also rose from 51.9 in April to 54. Electric vehicles remain a bright spot in the Swedish economy, and the country's industry associations are also lobbying the government to introduce relevant stimulus policies to continue promoting the development of the electric vehicle industry.

2024-11-08

2024-10-23

2024-10-22

2024-10-15

2024-10-14

Lithium-ion Battery | EV Battery Cost Down 90% in 15 Years

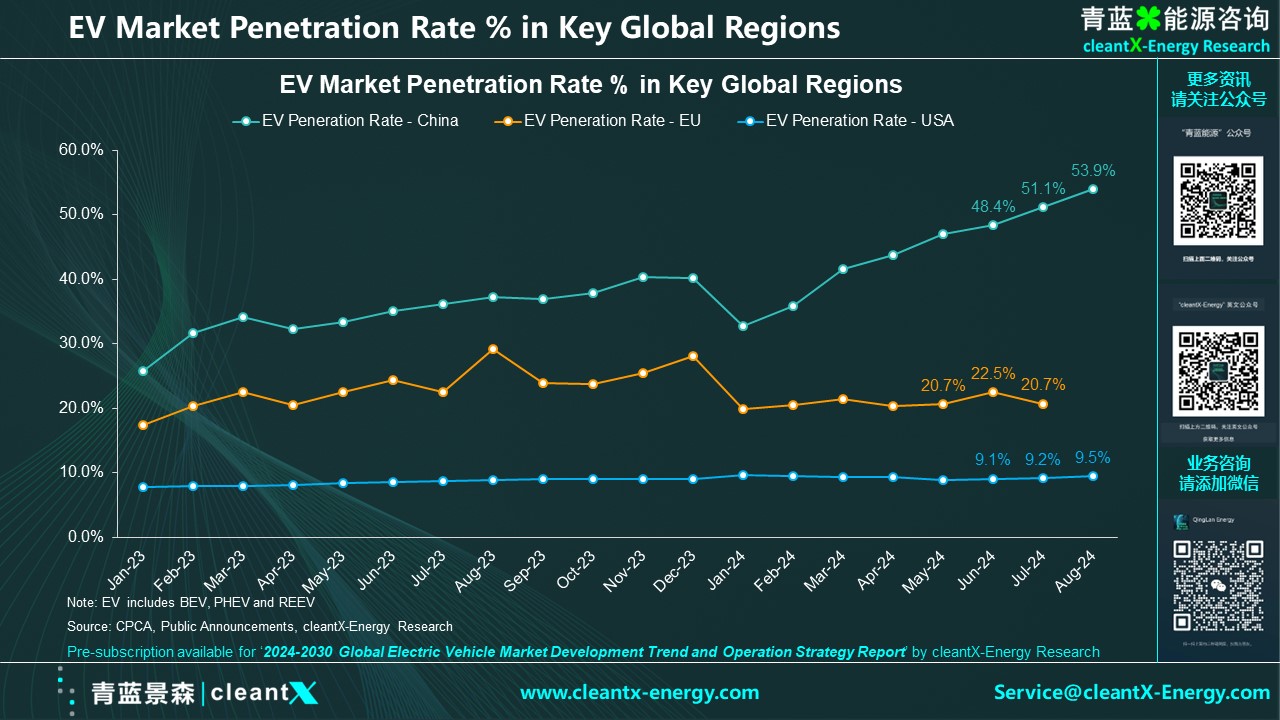

Electric Vehicle | China's EV Sales Keep Growing in August, with Market Penetration up to 53.9%

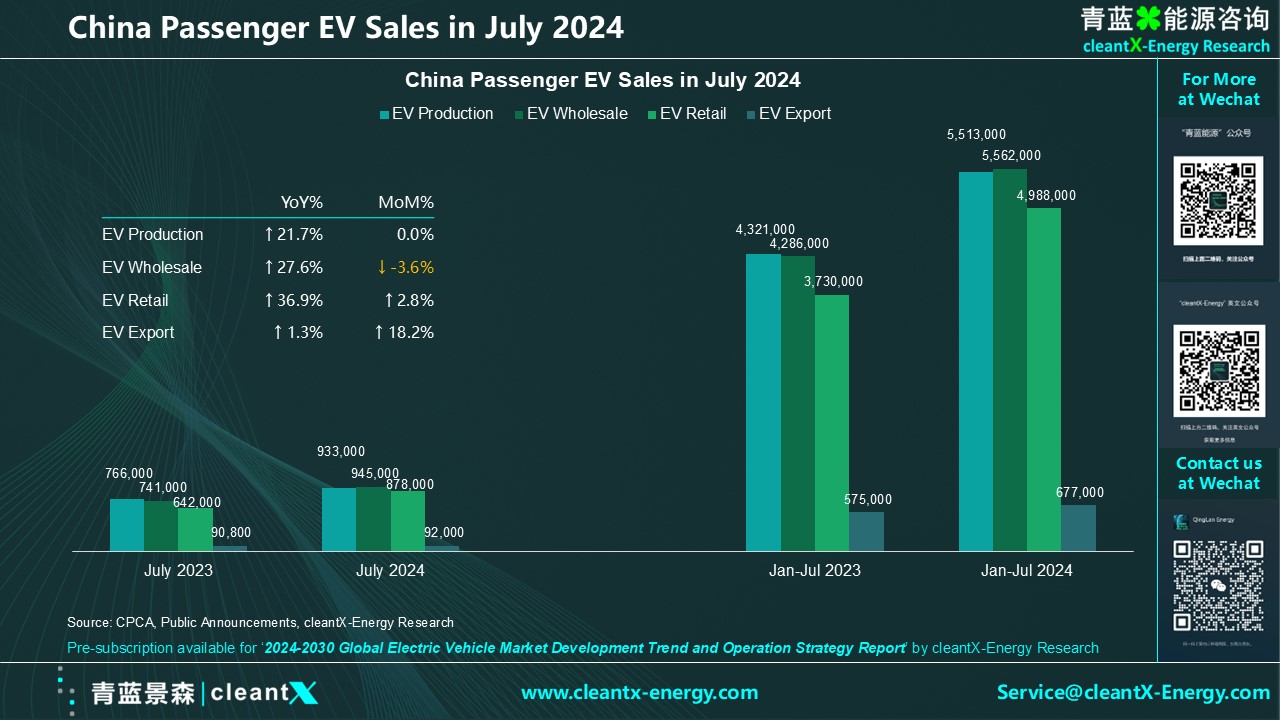

Electric Vehicle | China EV Sales up to 878,000 units in July 2024, with a retail penetration rate of 51.1%...

Lithium-ion Battery | Having IRA Tax Credits, The US Battery Production Cost to be Lower than China?

Electric Vehicle | Global EV Sales Record High in September

Electric Vehicle | Volkswagen Group's BEV Deliveries in Q3 Slide 10% Year-on-Year to 189,400 Units, but Up in China...

Electric Vehicle | EU sold 160,400 BEV and PHEV in July 2024, down 12.0% year-on-year; but HEV Sales Surge...

Electric Vehicle | The Impact of Trump Elected as US President on the Global Electric Vehicle Industry...