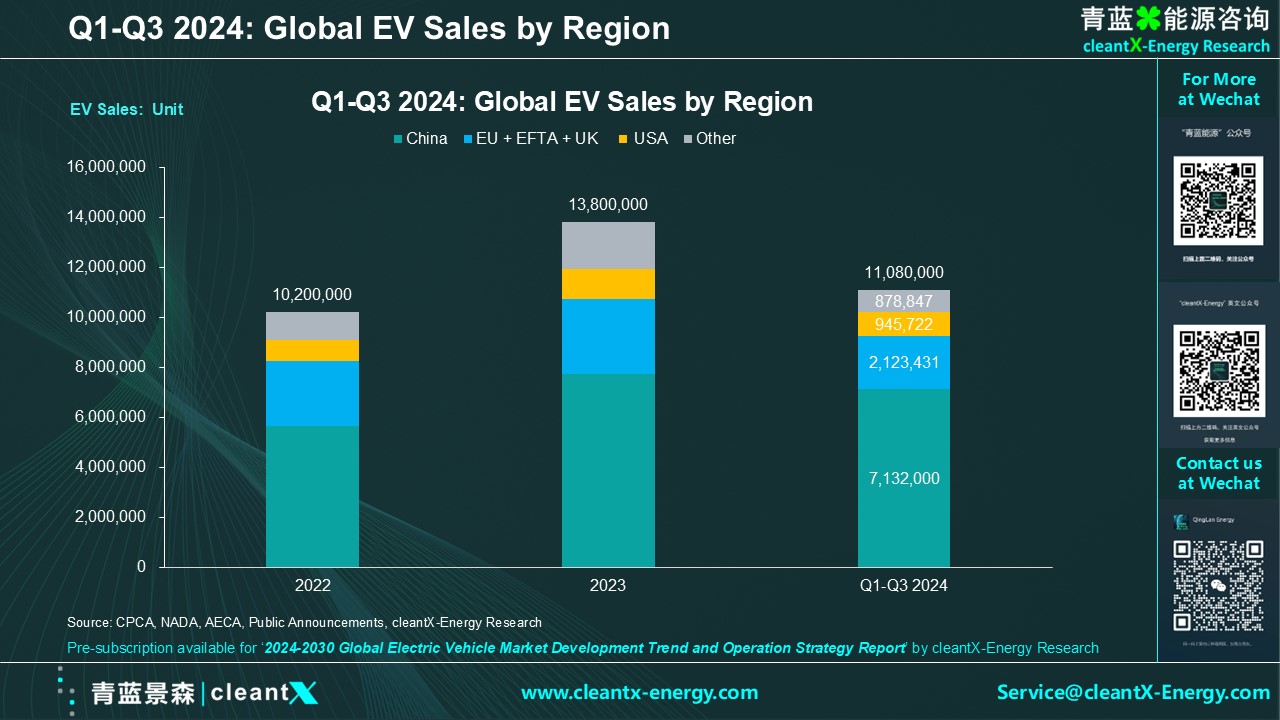

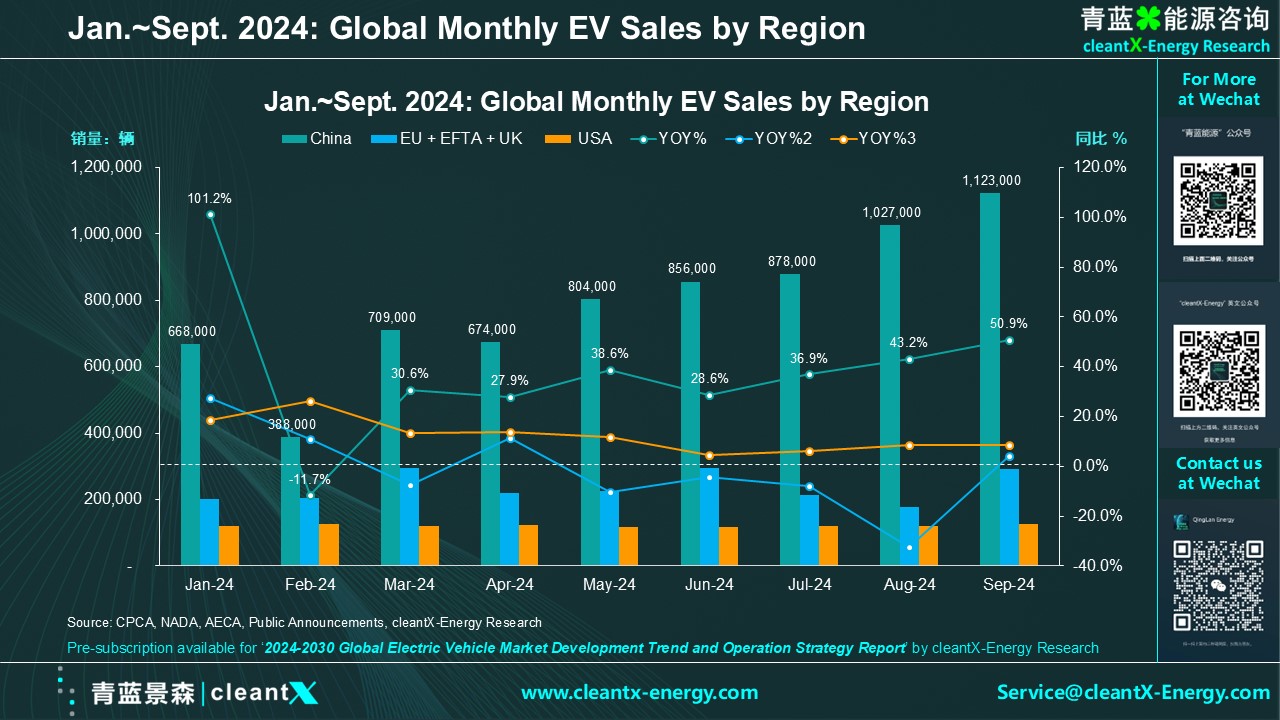

According to the public data summarized by the cleantX-Energy, the global electric vehicle sales reached 16.9 million units in September 2024, a year-on-year increase of 30.5%; from January to September 2024, the accumulative global electric vehicle sales reached 110.8 million units, a year-on-year increase of 21.3%.

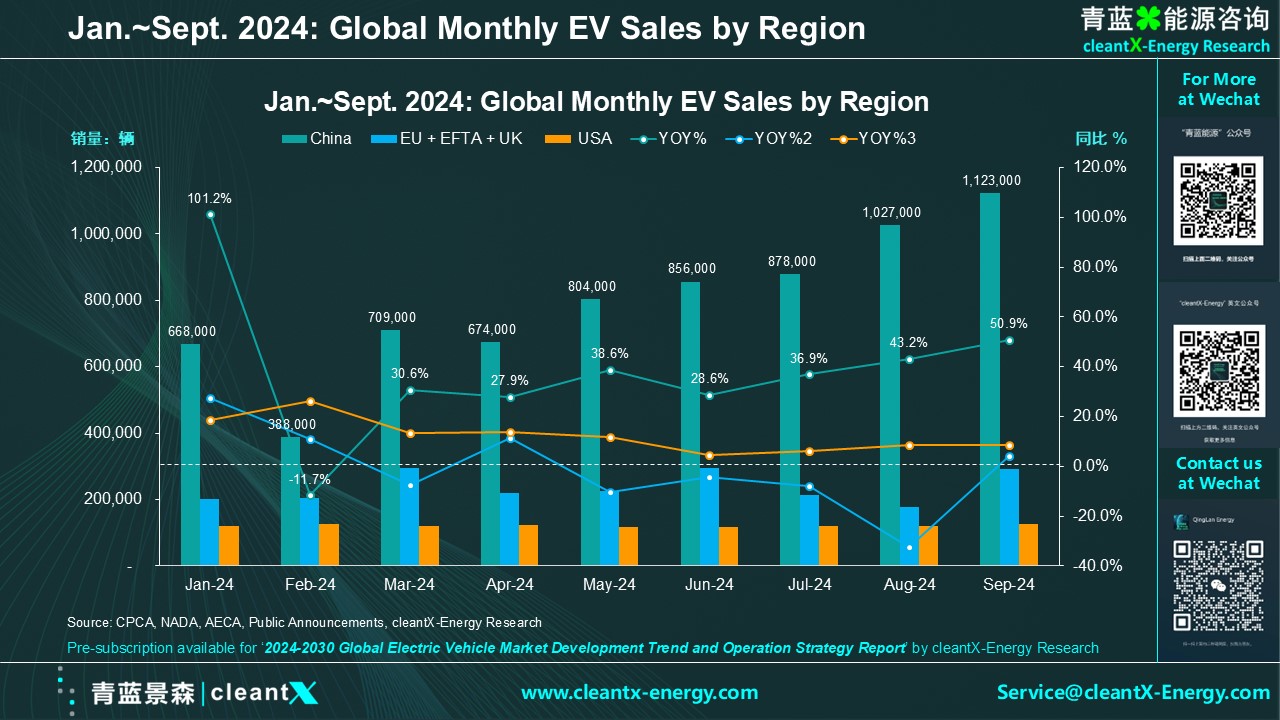

The Chinese market not only maintains the highest EV sales but also has a growth rate far higher than the European and US markets. In September 2024, the passenger electric vehicle retail sales reached 1.123 million units in China, a year-on-year increase of 50.9%, and a month-on-month increase of 9.6%. The cumulative retail sales from January to September 2024 reached 7.132 million units, a year-on-year increase of 37.4%.

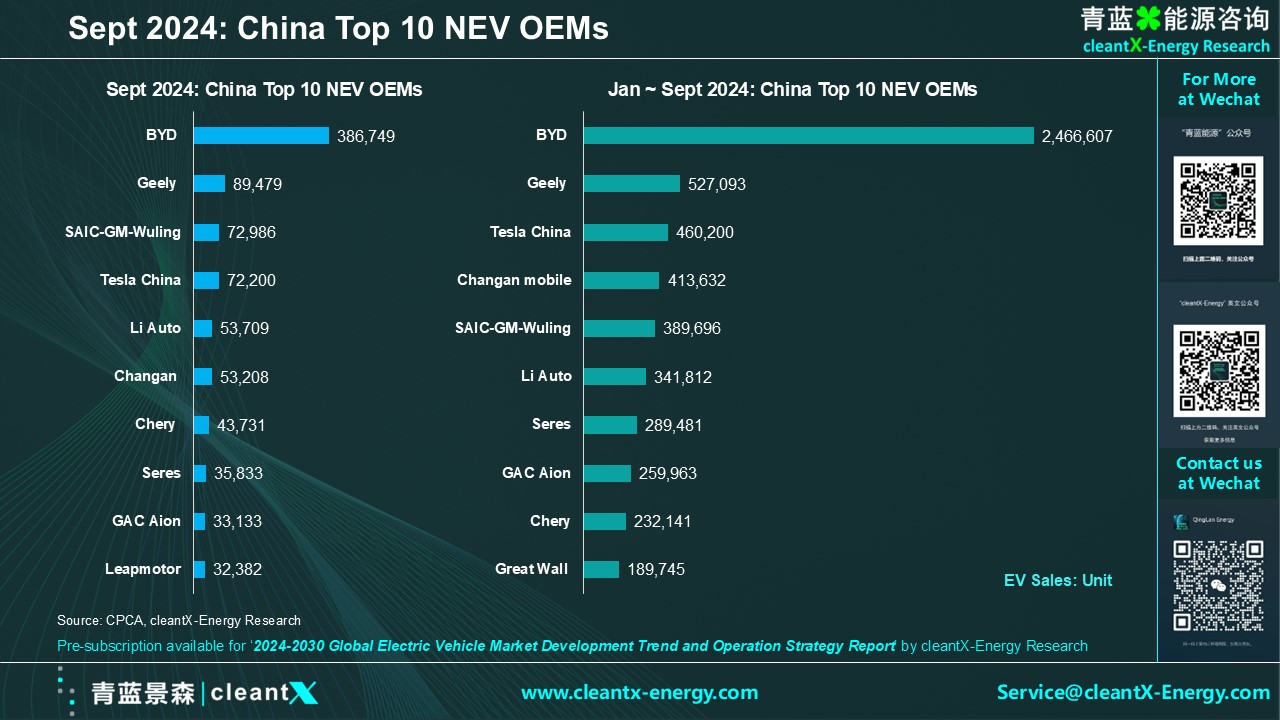

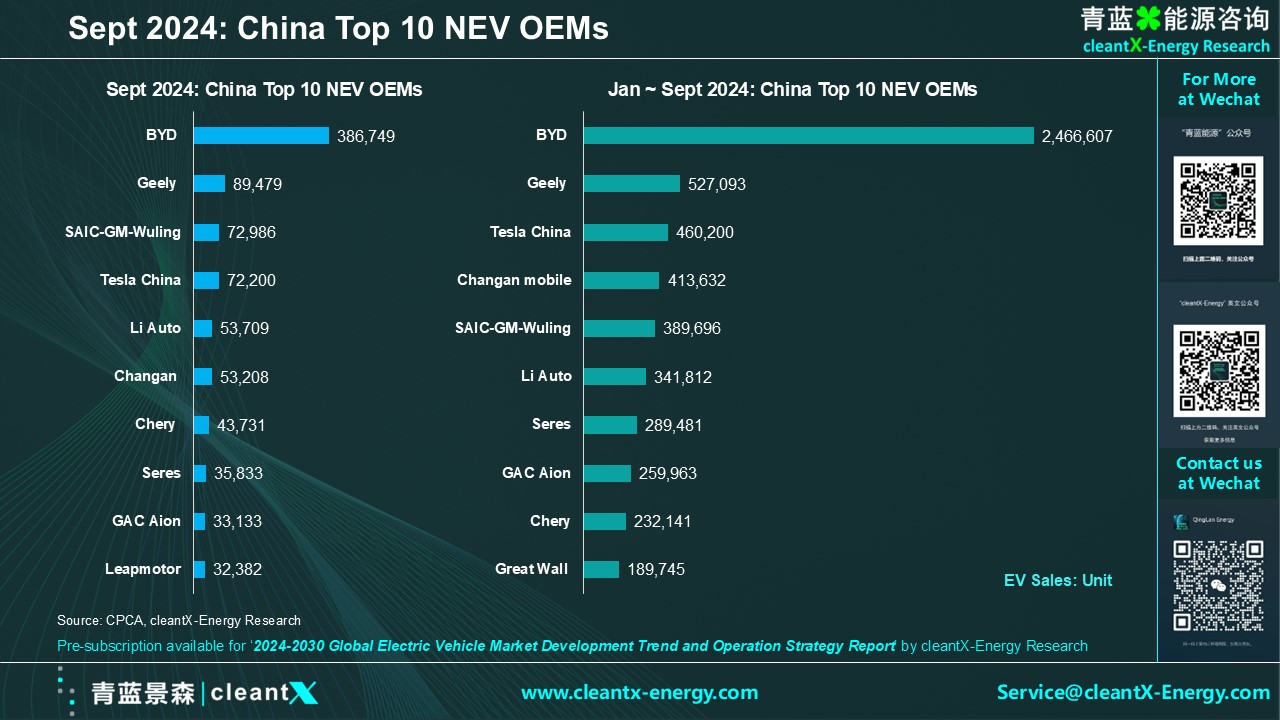

BYD continues to lead the Chinese EV market in sales, with a cumulative sales volume of 2.47 million units in the first nine months, a year-on-year increase of 30.9%, accounting for 34.6% of the total EV market in China. Considering BYD's sales volume of 3 million units last year, BYD's sales to date this year are already very impressive. Geely ranks second with a cumulative sales volume of 527,000 units, a year-on-year increase of 95.8%. Tesla China ranks third with a cumulative sales volume of 460,000 units, but the year-on-year growth is only 6.1%. With the support of Huawei's intelligent driving system, Seres has a cumulative sales volume close to 300,000 units this year, recording the highest year-on-year growth rate of 621.7%.

In September 2024, it is estimated that the EV sales in the European region (including the EU, EFTA, and the UK) will be around 291,000 units, a year-on-year increase of 4.2%, and the cumulative EV sales in the European market from January to September will be approximately 2.12 million units. The growth in the European market is mainly driven by the UK (+24%) as well as increases in the Italian, German, and Danish markets.

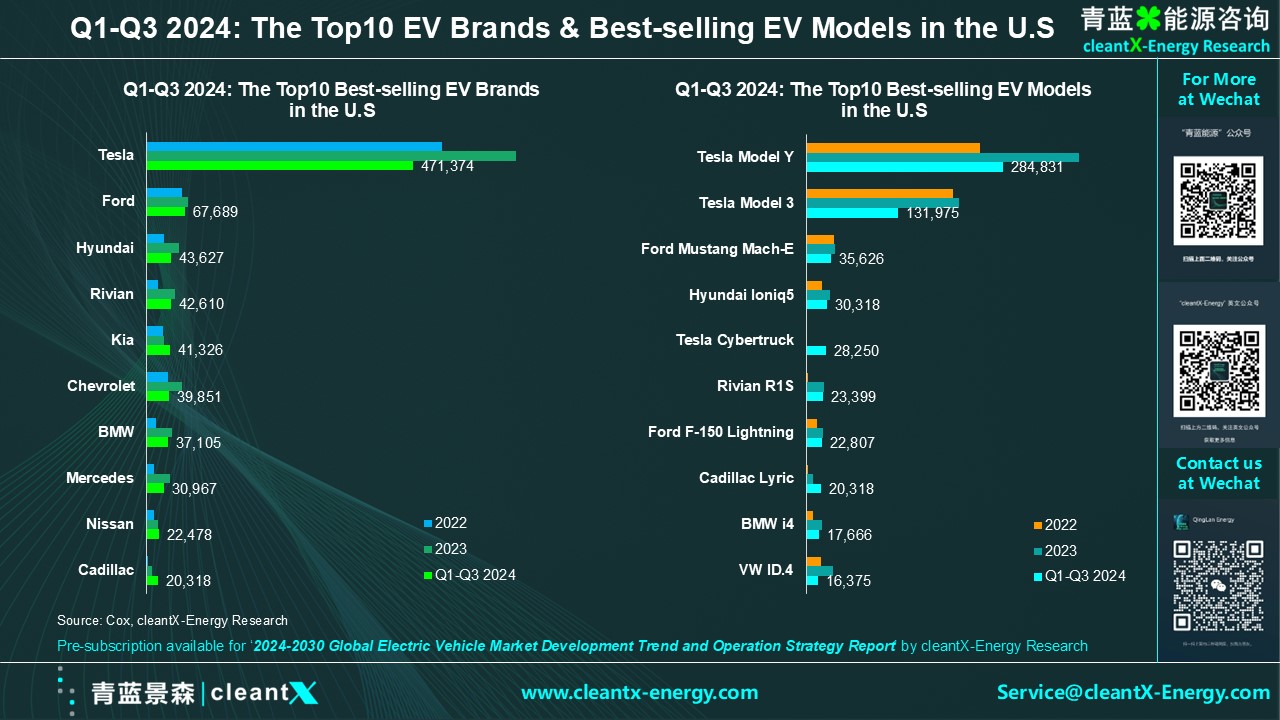

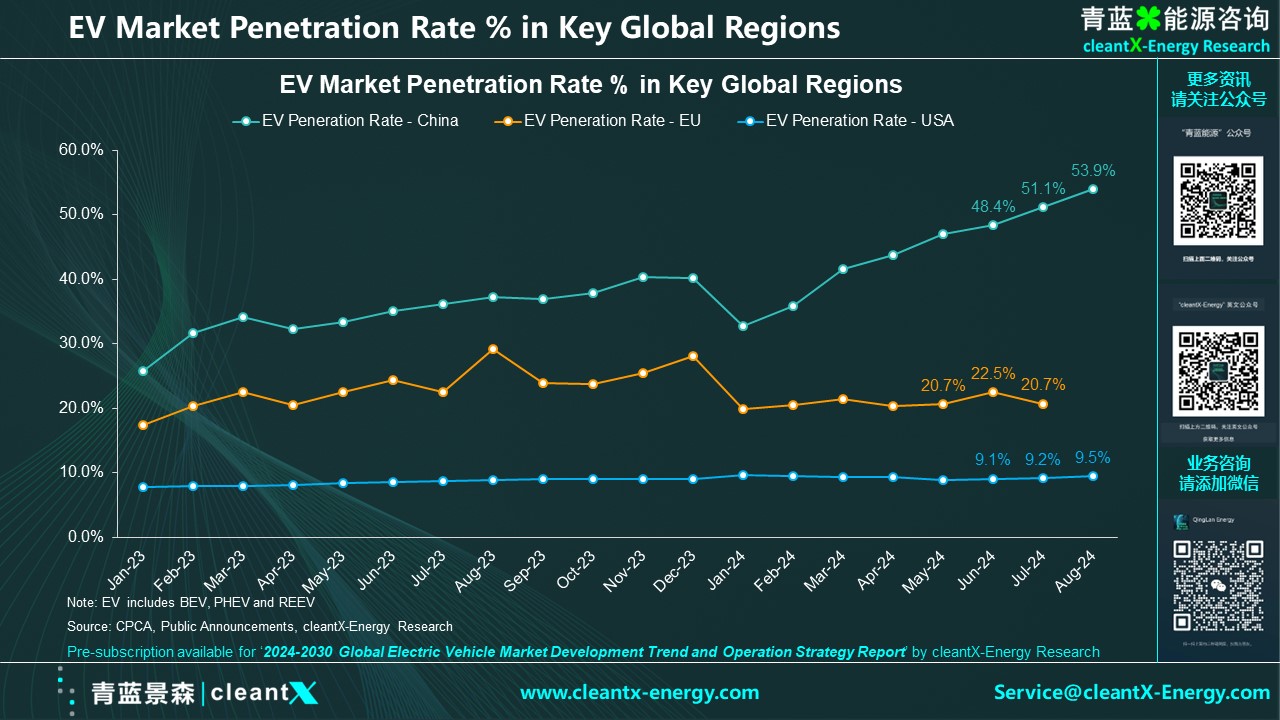

The US market has seen a cumulative EV sales volume of 946,000 units in the first three quarters of this year, a year-on-year increase of 8.7%. The US EV market penetration rate reached 8.9% in the third quarter of this year, 1.1 percentage points higher than the 7.8% in the third quarter of 2023.

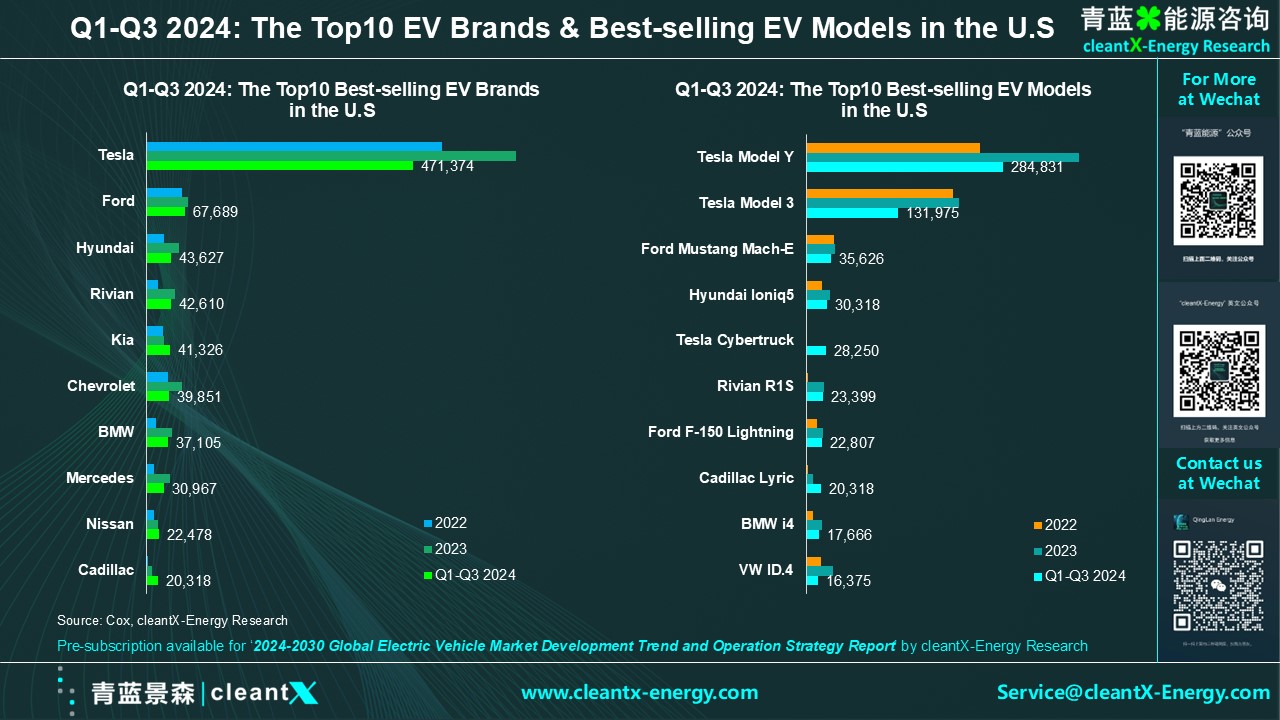

Tesla remains the best-selling EV brand in the US, with a cumulative sales volume of 471,000 EVs in the US from January to September, but Tesla's market share in the US EV market has fallen below 50%, dropping from 64.3% in the same period of 2022 to 55.1% in the same period of 2023, and down to 49.8% this year. In addition to the consistently top-selling Tesla Model Y and Model 3, the Cybertruck, launched at the end of last year, has also achieved sales of nearly 30,000 units in the US market. Hyundai Motor Group (including Hyundai and Kia brands) ranks second with a cumulative sales volume of 85,000 EVs in the US this year, a year-on-year increase of 32.4%. General Motors, ranked third, sold a total of 69,500 EVs this year with strong sales from its three core brands - Cadillac, Chevrolet, and GMC, a year-on-year increase of 23.9%. Ford Motor Company, ranked fourth, sold 67,700 EVs in the first nine months of this year, a year-on-year increase of 45%.

For more details on the global electric vehicle markets, please contact the cleantX-Energy Research to request the "2023-2030 Global Electric Vehicle Market Research and Development Strategy Report". The pre-subscription for the 2024 update version is available. The cleantX-Energy Research can also provide customized reports on the global electric vehicle markets. If you have any further inquiries, please click the below to contact us.