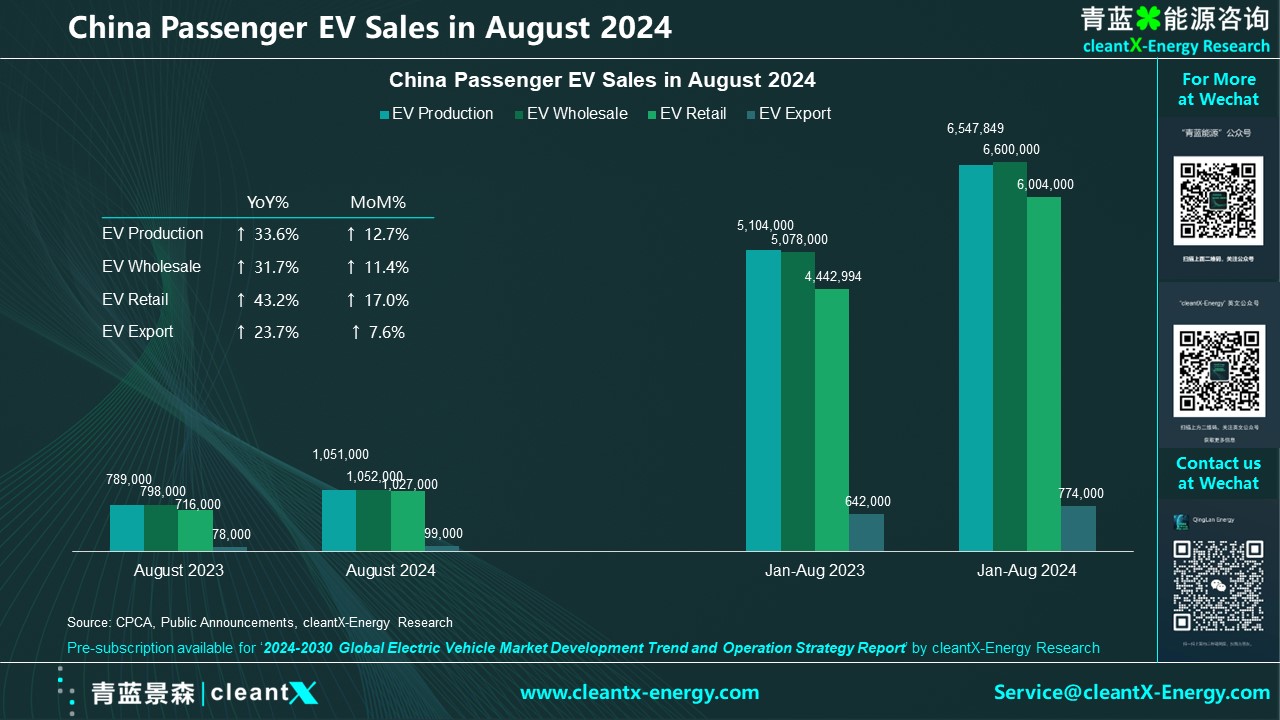

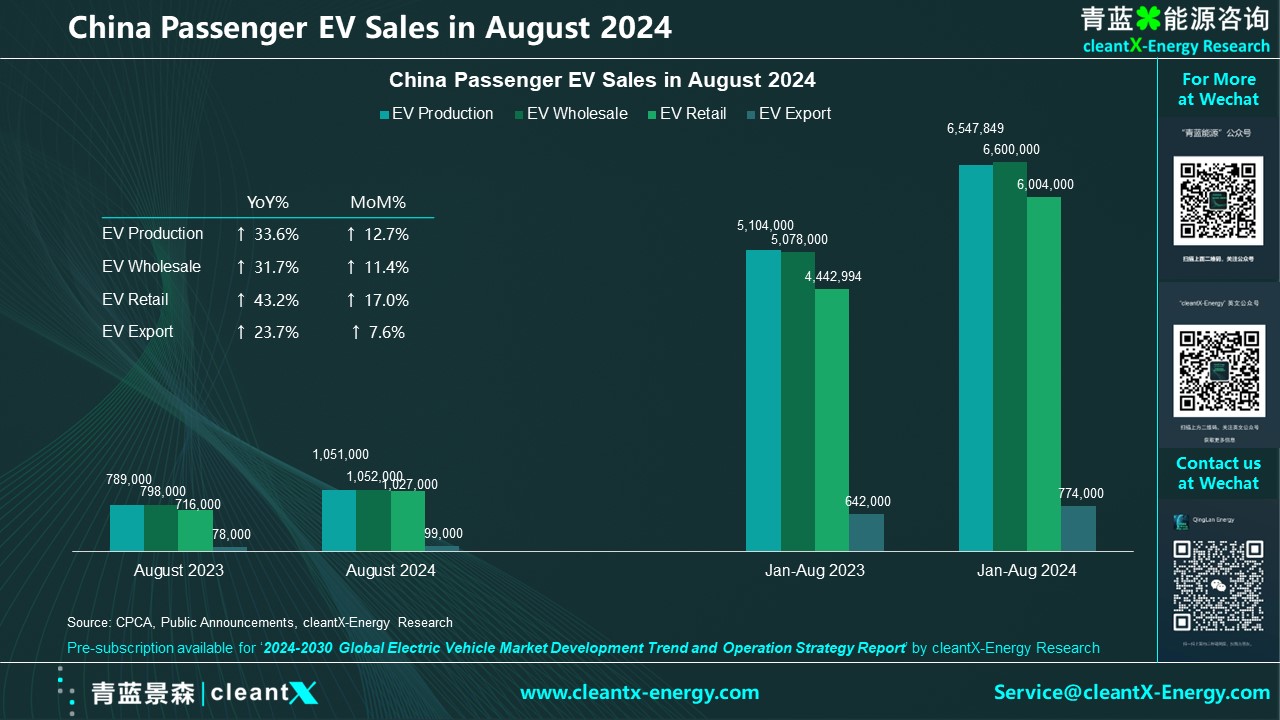

According to statistics from the China Passenger Car Association, in August, the production of passenger electric vehicles in China reached 1.051 million units, a year-on-year increase of 32.6%, and a month-on-month increase of 12.7%. From January to August 2024, a total of 6.572 million units were produced, a year-on-year increase of 28.5%. In the same month, the wholesale sales of passenger electric vehicles reached 1.052 million units, a year-on-year increase of 31.7%, and a month-on-month increase of 11.4%. From January to August 2024, wholesale sales amounted to 6.622 million units, a year-on-year increase of 30.2%. In August, the retail sales of passenger electric vehicles reached 1.027 million units, a year-on-year increase of 43.2%, and a month-on-month increase of 17.0%. From January to August 2024, retail sales reached 6.016 million units, a year-on-year increase of 35.3%. In August, the export of passenger electric vehicles was 99,000 units, a year-on-year increase of 23.7%, and a month-on-month increase of 7.6%. From January to August 2024, exports amounted to 787,000 units, a year-on-year increase of 20.1%.

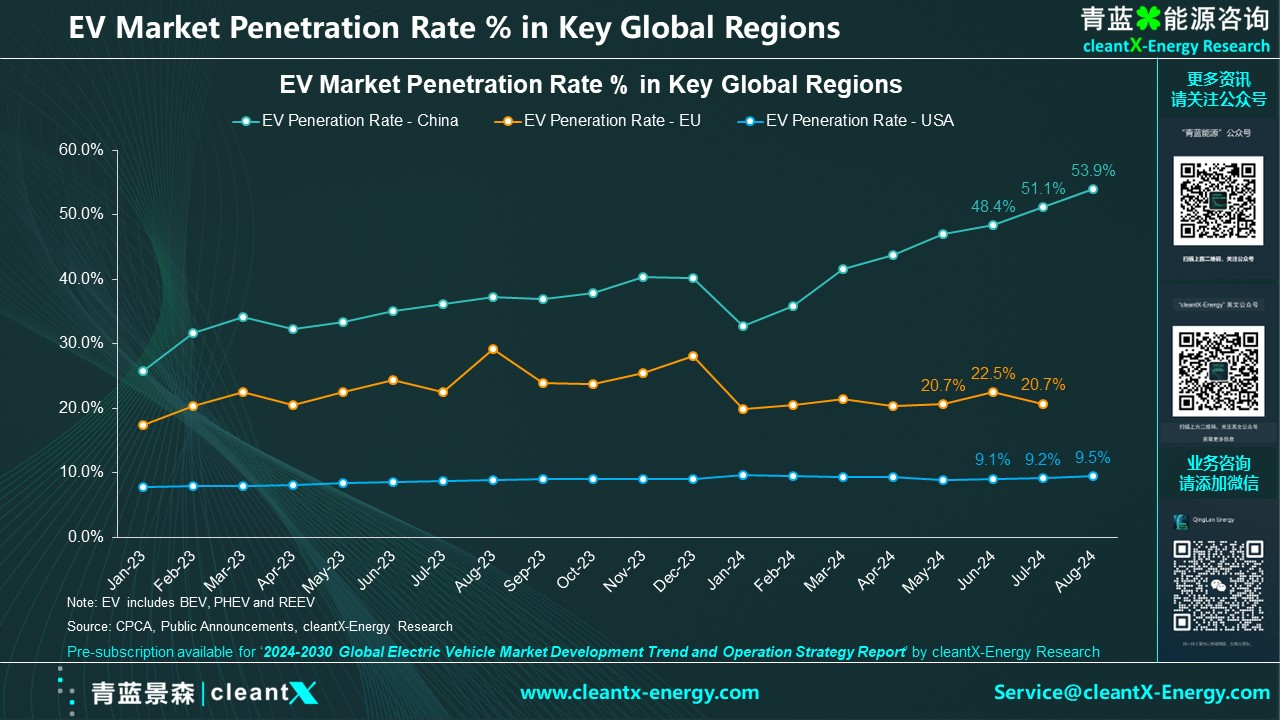

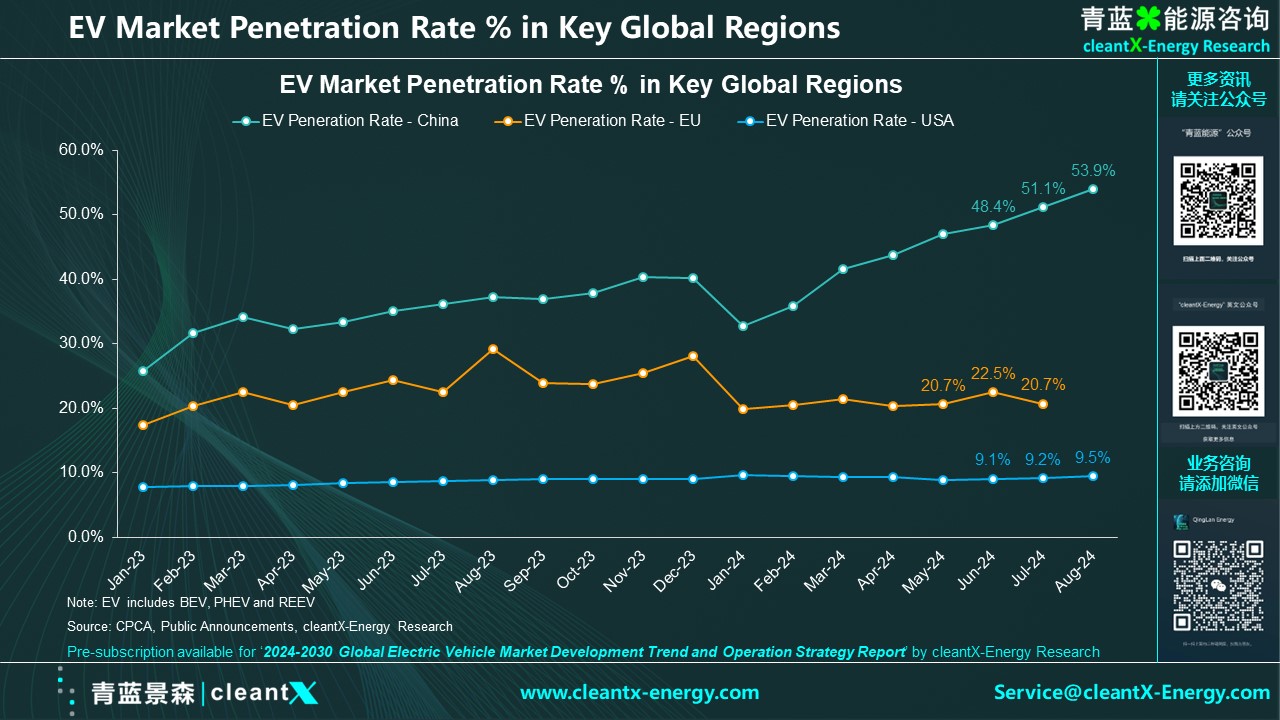

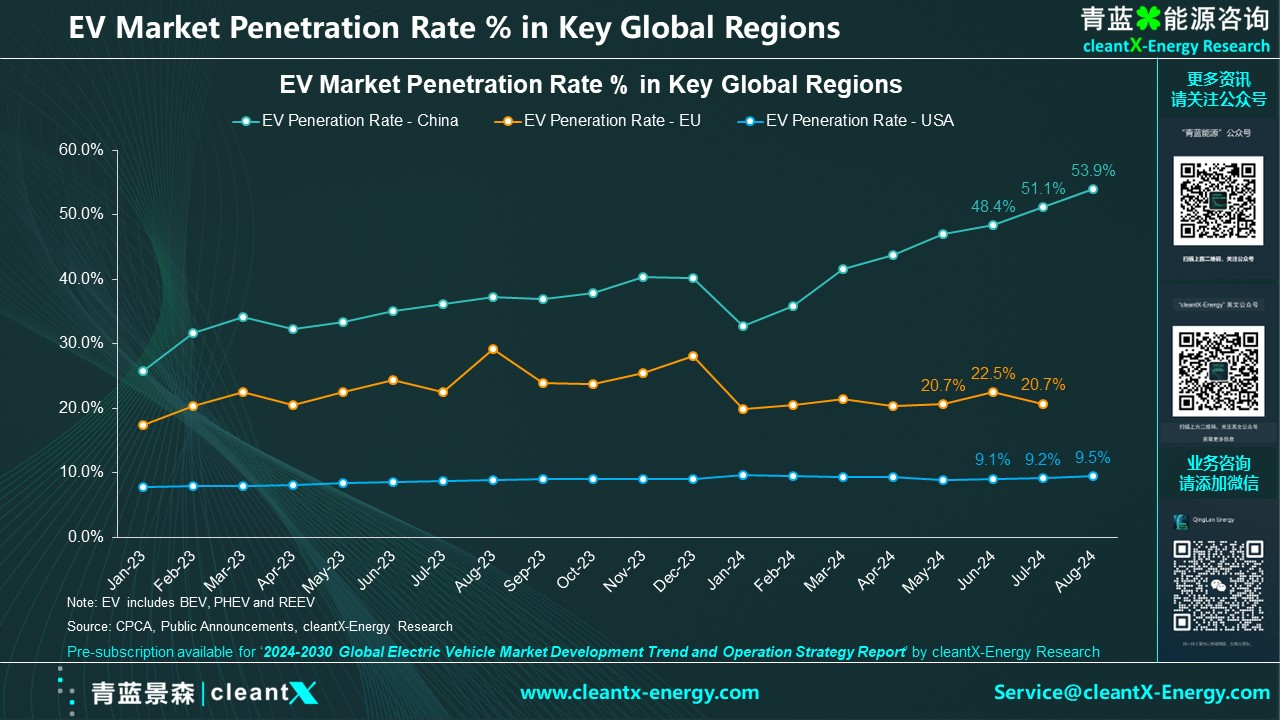

In terms of the market penetration rate, the retail penetration rate of electric vehicles in August continued to climb to 53.9% in China after exceeding 50% in July, an increase of 16.6 percentage points from the same period last year's 37.3%. Among them, the penetration rate of electric vehicles in Chinese local brands reached 75.9%; in luxury cars, the penetration rate was 33.5%; while in mainstream joint venture brands, the penetration rate of electric vehicles was only 8%. The market penetration rate of electric vehicles is expected to further increase. According to a recent comment from William Li, CEO of NIO, the penetration rate of electric vehicles in China is expected to exceed 80% within two years.

From the perspective of car manufacturers, the overall growth of passenger electric vehicle OEMs in August was pretty strong, with 19 manufacturers breaking through the 10,000-unit mark in monthly wholesale sales. The main local car manufacturers such as BYD, Geely, Chang’an, Chery, and SAIC-GM-Wuling have strong sales in electric vehicles. Among the key joint venture brands, SAIC Volkswagen and FAW-Volkswagen's combined electric vehicle wholesale in August was 19,968 units, accounting for more than 50% of the joint venture electric vehicle sales, and Volkswagen's persistant electrification strategy has begun to generate good results. In August, Volvo and GAC Toyota's electric vehicles also showed a significant increase.

The internal differentiation of electric vehicles is also accelerating. Looking at the market share of plug-in hybrids and range-extended vehicles, since entering 2024, the market share of plug-in hybrids (PHEV) and range-extended electric vehicles (REEV) has risen significantly, while the sales of pure electric vehicles (BEV) have gradually weakened. Data shows that in August, the wholesale sales of pure electric vehicles were 592,000 units, a year-on-year increase of 6.6%, and a month-on-month increase of 17.3%; the plug-in hybrid electric vehicle sales in August were 345,000 units, a year-on-year increase of 84%, and a month-on-month increase of 9%; the range-extended electric vehicle wholesale in August was 115,000 units, a year-on-year increase of 109%, and a month-on-month decrease of 6%. In addition, in the August EV wholesale structure, pure electric accounted for 56%, plug-in hybrids 33%, and range-extended 11%. Comparatively, in August 2023, pure electric was 70%, plug-in hybrids 24%, and range-extended 7%. Range-extended effectively compensates for the range anxiety of pure electric and should be considered a branch of pure electric.

Among them, BYD still leads in the field of pure electric and plug-in hybrid electric vehicles; with the hot sales of range-extended electric vehicles from Li Auto and Seres, the range-extended technology route has gradually moved from the periphery to the mainstream. In addition to a few car manufacturers such as Great Wall and NIO, almost all mainstream OEMs have developed or are about to develop range-extended models, with Changan Automobile and LeapMotor's range-extended electric vehicles performing particularly well.

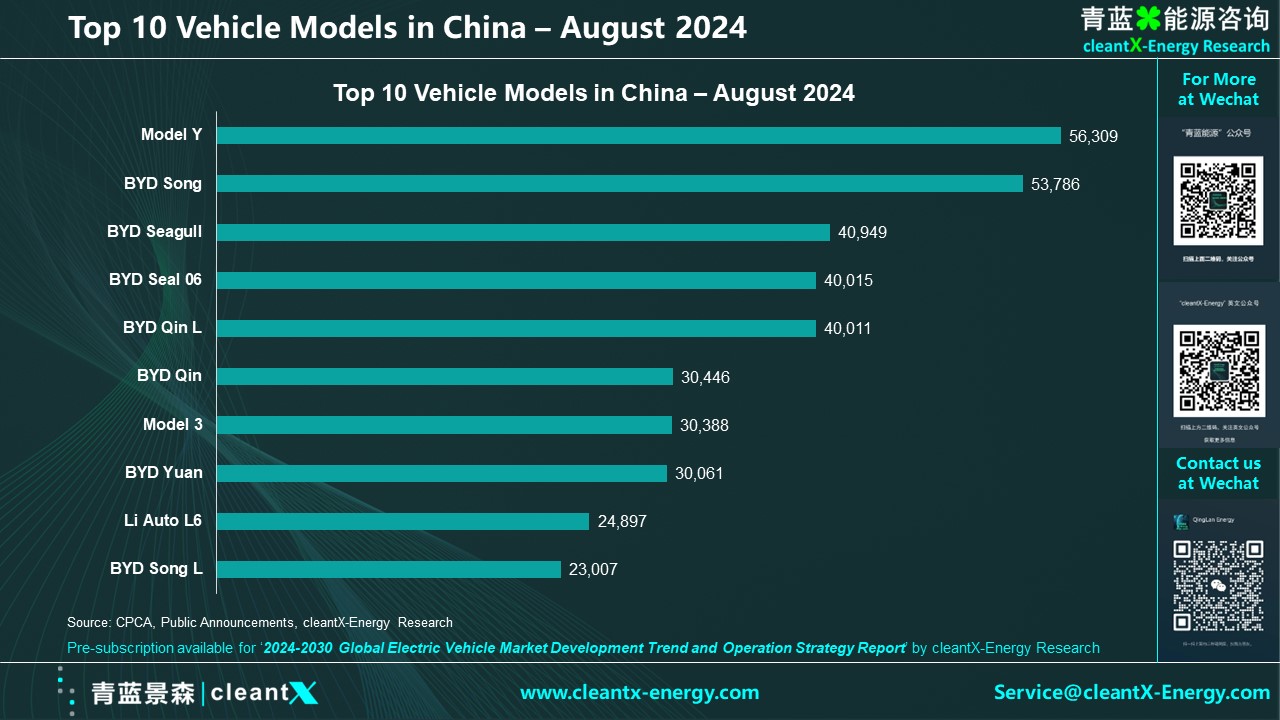

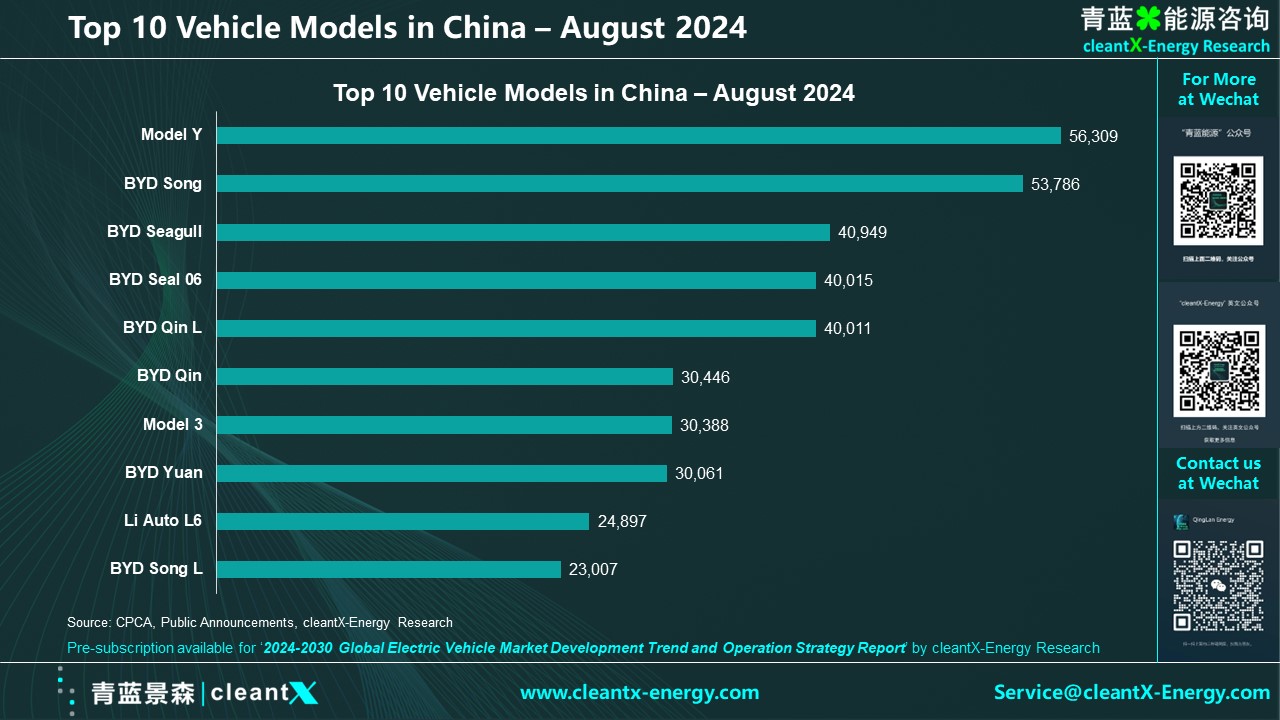

From the perspective of car models, in August, there were 16 models with wholesale sales of more than 20,000 units in China, of which 10 were electric models. In addition to Model Y and Model 3 and Li Auto L6, other best-selling models are all BYD brands.

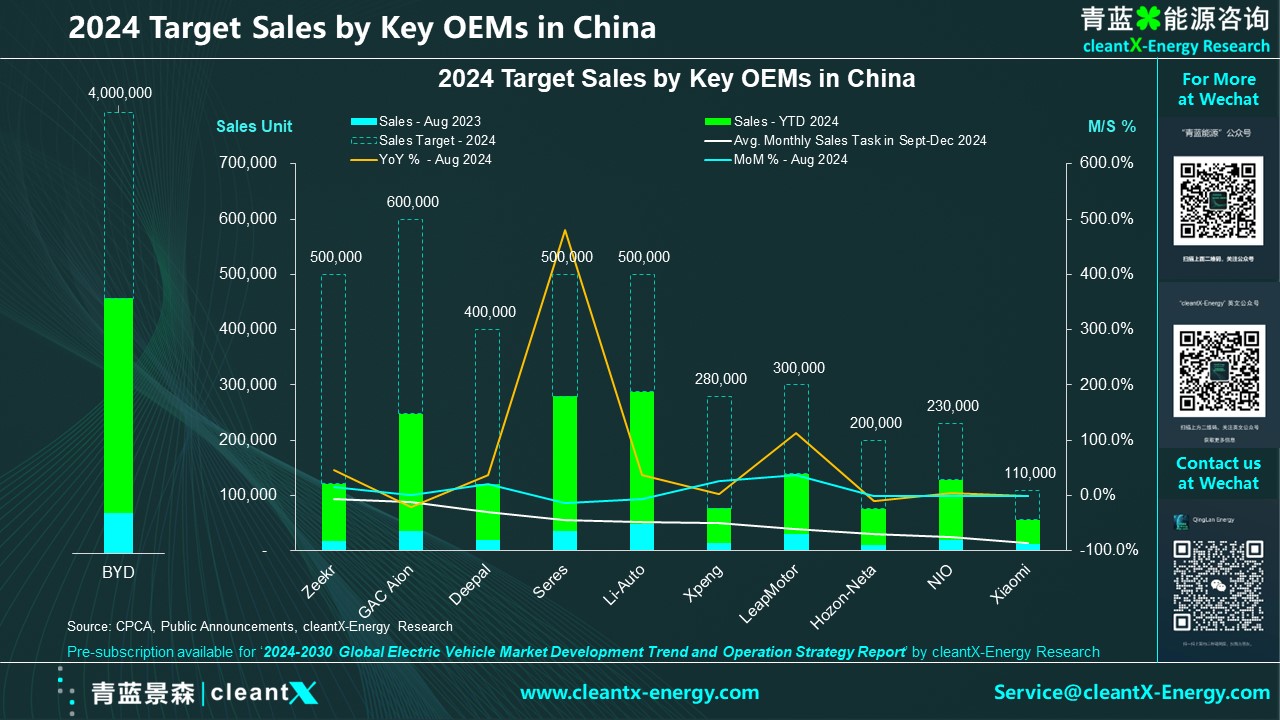

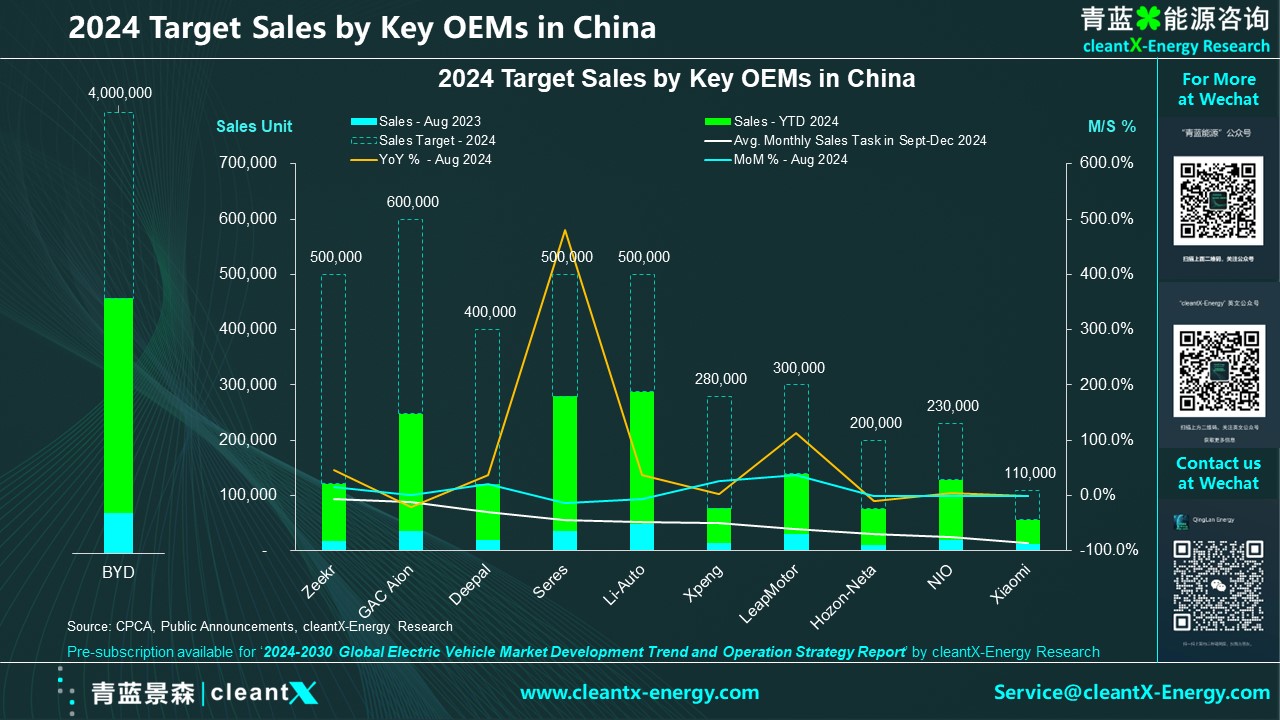

From the perspective of start-up car manufacturers, the retail share of these new forces in August was 16.0%, an increase of 2.1 percentage points year-on-year; the sales performance of companies such as Seres, LeapMotor, Deepal, and NIO is still relatively strong in terms of year-on-year and month-on-month growth. Looking at the target sales of each company, from January to August of this year, the sales performance of companies such as Seres, LeapMotor, Li Auto, NIO, and Xiaomi is relatively good, and the pressure to achieve sales targets in the next few months is smaller. Recently, BYD adjusted its annual sales target from 3.6 million units to 4 million units, and it is expected that BYD will launch a new wave of sales offensive in the next few months.

According to public data, in 2022, China's share of the world's passenger electric vehicle market exceeded 63%. In 2023, China's share of the world market was 64%, and from January to July 2024, it continued to rise to 64.5%, of which China's passenger electric vehicle market share reached 67% from April to July.

However, while China's electric vehicle is accelerating forward, the global overall has begun to slow down, especially the trend of electric vehicles in Europe and the United States has slowed down significantly. According to statistics from the cleantX-Energy Research, from January to July this year, the total sales of BEV and PHEV electric vehicles in European countries, including EU, EFTA (i.e., Iceland, Norway, Switzerland) and the UK, were 1.654 million units, with a year-on-year growth rate of only 0.3%; the sales of electric passenger cars in the United States were 845,000 units, with a year-on-year growth rate of 13.2%. Both Europe and the United States are below the year-on-year growth rate of over 30% in China.

However, despite the slowdown in the growth rate of the electric vehicle market in Europe and the United States, the absolute sales of electric vehicles continue to increase. A couple of electric vehicle manufacturers in Europe and the United States are making strategic adjustments according to market changes, but in general, the transition to electrification and digitalizaiton has not changed.