According to the latest statistical analysis by Benchmark in the United States, it is possible that by 2030, the cost of battery production in the United States could be lower than that in China, if the tax credits in the Inflation Reduction Act (IRA) are taken into account.

The Inflation Reduction Act passed in August 2022 has largely stimulated investment in the lithium battery industry chain in the United States. According to Benchmark statistics, since August 2022, the United States has added 23 new giga factories under construction, bringing the total number of battery factories in the United States to 40. By 2030, the planned total production capacity of batteries in the United States will increase by 537.0 GWh to 1,290.6 GWh.

According to estimation, the IRA will provide a manufacturing tax credit equivalent to $35 per kilowatt-hour for batteries produced domestically in the United States by 2029. If the tax credits from the IRA are included in battery manufacturing, by 2029, the average production cost of batteries in the United States could drop from $111.8/kWh to $76.8/kWh. This would make the giga factories in the United States the lowest-cost battery factories globally.

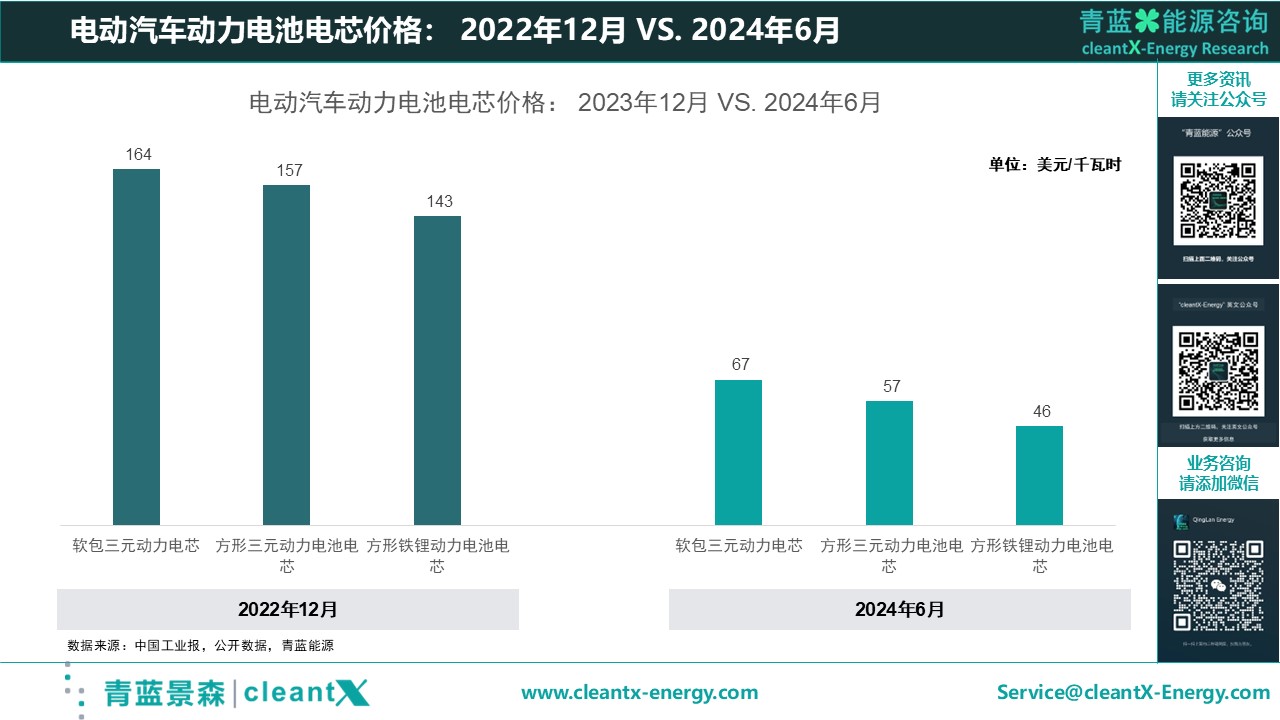

Currently, China has a significant advantage in battery production costs compared to the United States. It is estimated that the average production cost of nickel-manganese-cobalt (NMC) batteries in China is $95.81/kWh, compared to an average cost of $98.06/kWh for NMC batteries in the United States, not considering tax credits.

Tax credits can indeed help battery manufacturers producing domestically in the United States to improve their profits. LG Energy Solution, a South Korean company, stated in its second-quarter report this year that the IRA tax credits turned its operating loss of 25.3 billion won (1.3 billion yuan) into a profit of 19.5 billion won (1 billion yuan). Panasonic Energy also stated that by the fiscal year ending in 2024, the IRA tax credits have increased its profit margin from 7% to 18%.

However, the expectation that the United States will have the lowest battery costs may not be absolutely optimistic, as there are a couple of uncertainties that could increase costs.

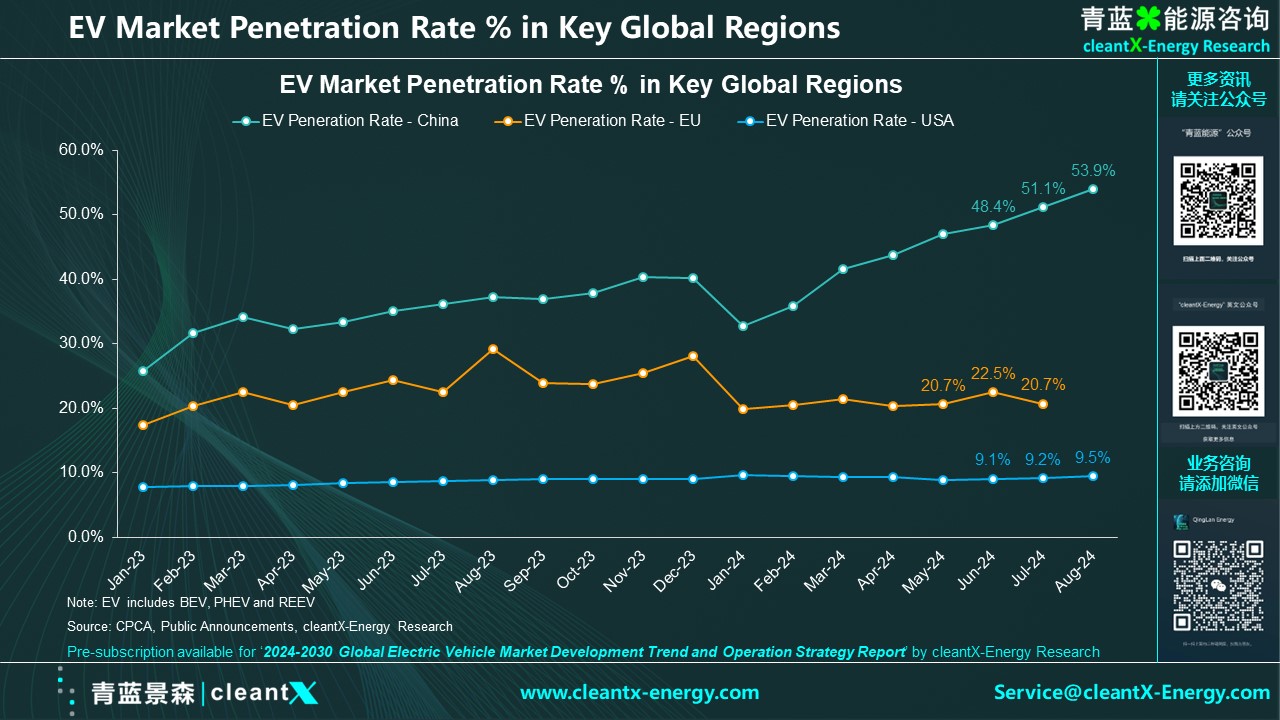

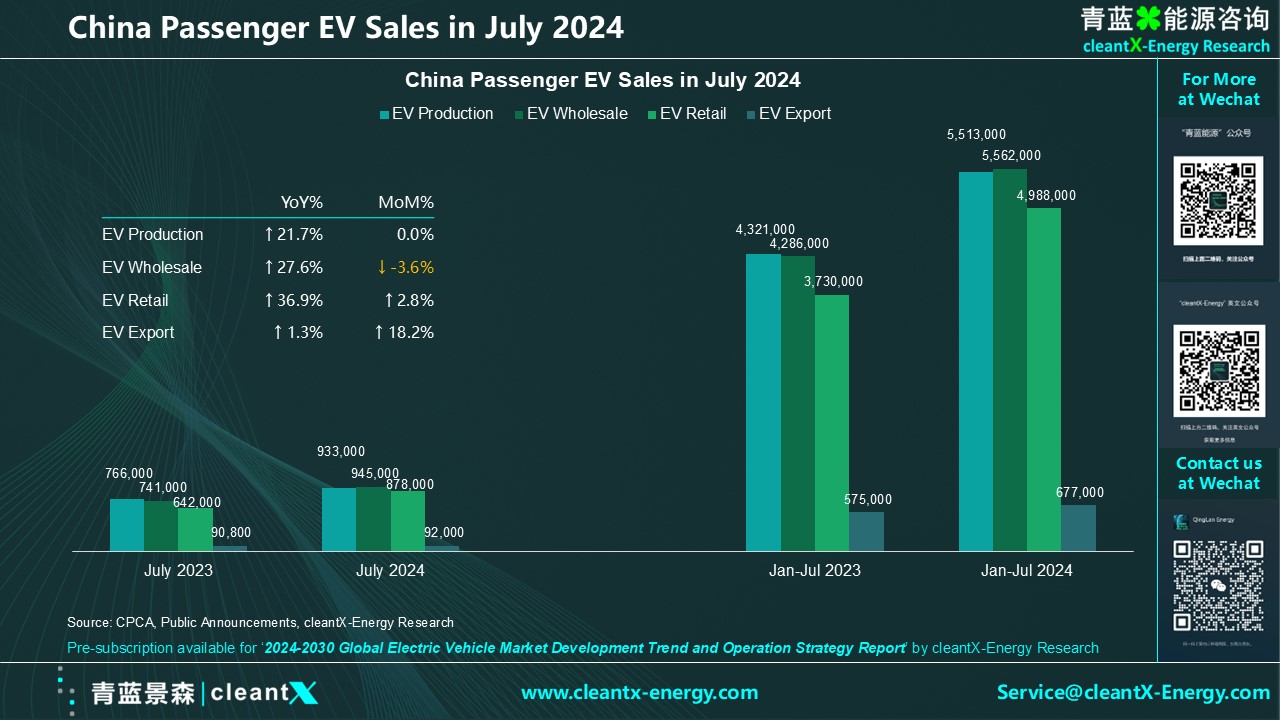

The progress of battery production in the United States depends on the growth of demand in the application markets, especially the electric vehicle market. This year, automakers including Ford and General Motors have reduced their production plans for electric vehicles, which has also brought uncertainty to U.S. power battery manufacturers.

General Motors stated that it will not reach the original production target of 1 million electric vehicles by 2025 and has lowered its electric vehicle target for this year. Ford has also adjusted the launch schedule for its electric vehicle models and reduced the proportion of expenditure on pure electric vehicles.

In July of this year, LG Energy Solution also stated that it has slowed down the investment progress in the third Michigan battery factory in cooperation with General Motors, and adjusted the battery production capacity eligible for IRA tax credits this year from 45~50GWh to 30~35GWh, based on "changing customer demand."

Additionally, the construction period and progress of factories in North America are also significant cost-influencing factors. It is estimated that among the 413 GWh battery production capacity planned in North America, more than one-third (151 GWh) is still in the early stage of ground engineering (ground clearance or ground works) and has not yet started construction. In contrast, only 14% (81 GWh) of China's 581 GWh battery production capacity plan is in the ground engineering stage. Moreover, the average construction period for factories in North America is close to 30 months, while the construction time for factories in China is only about 20 months.

If the maturity of upstream lithium refining and production capabilities of battery materials is also considered, the United States may not be able to truly achieve a competitive advantage in battery costs compared to China. Battery production in the United States also needs to take into account factors such as labor unions, which will inevitably increase labor costs. For example, this summer, Ultium Cells, a joint venture between General Motors and LG Energy Solution in Lordstown, Ohio, reached an agreement with a labor union to increase worker wages by 30% over three years.