Please enter your registered phone number below to receive the verification code

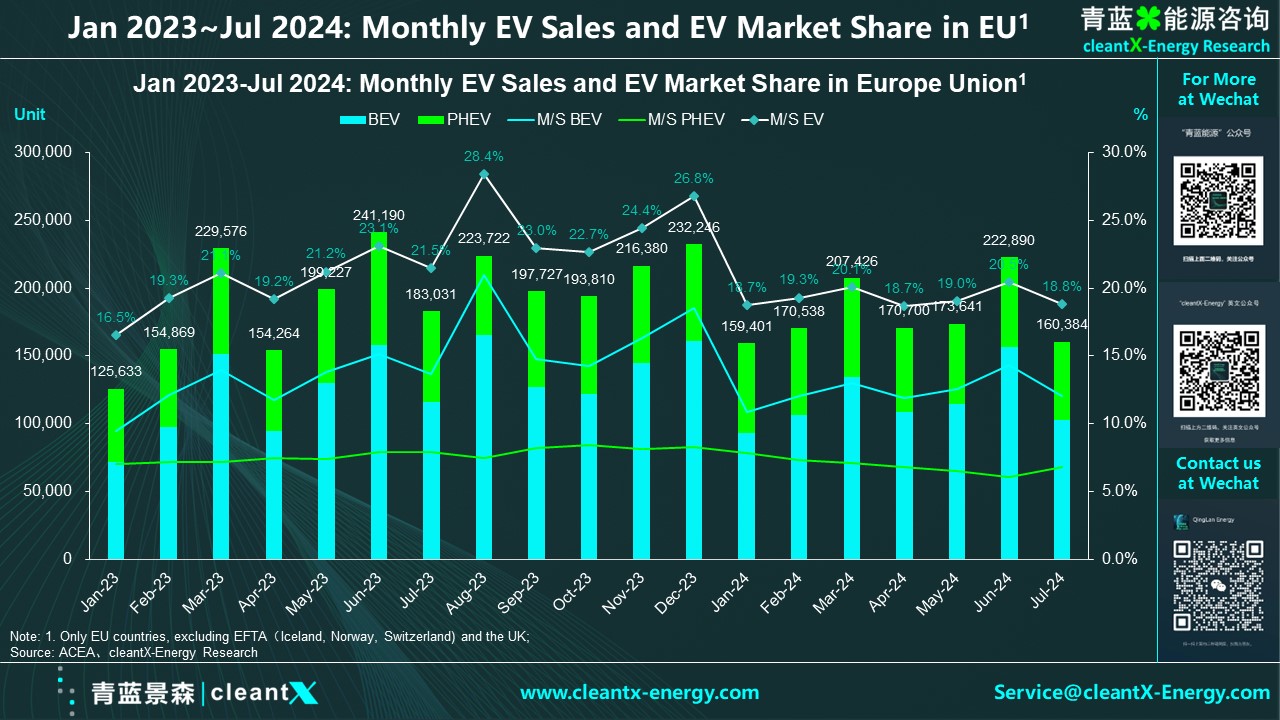

In July, the combined sales of BEVs and PHEVs in the EU reached 160,400 units, accounting for 18.8% of the EU car market, a year-on-year decrease of 12.0%.

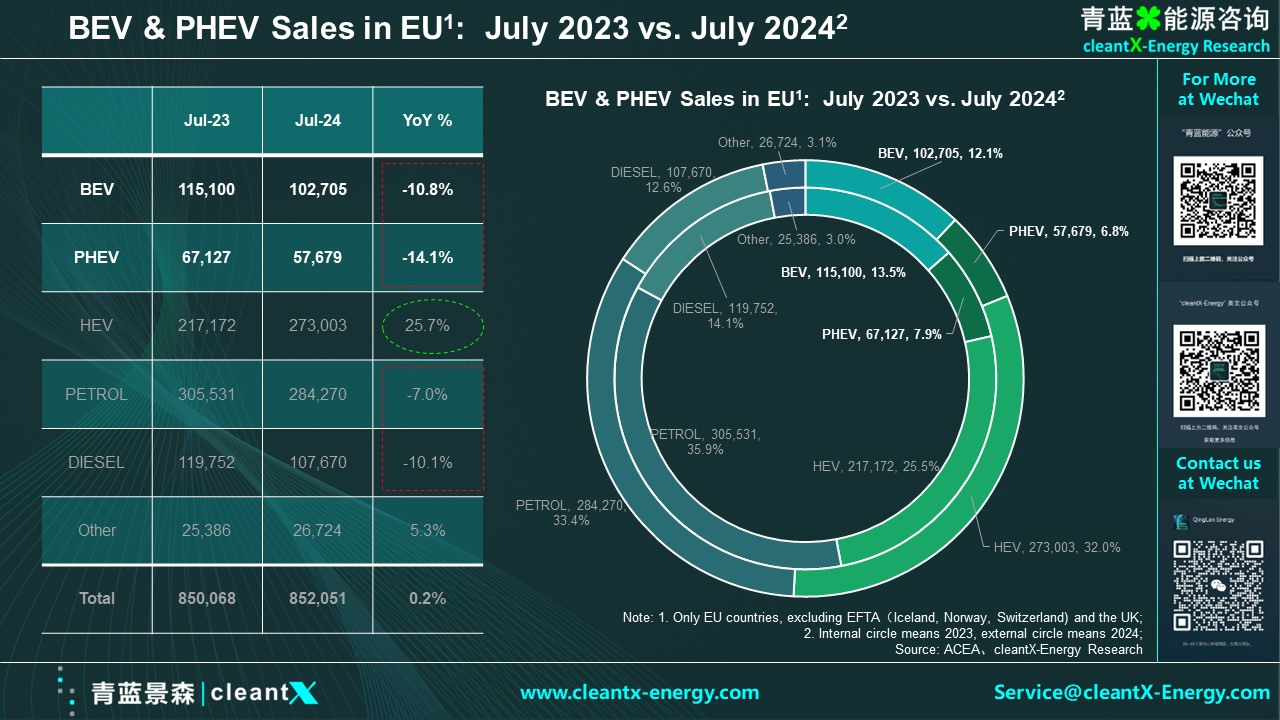

In July, the total market share of gasoline and diesel cars in the EU also decreased from 50% to 46%. However, the sales of Hybrid Electric Vehicles (HEVs) saw a significant increase of 25.7%. The HEV sales in the EU in July reached 273,000 units, and their market share also grew from 25.5% of the same period last year to 32%. All four of the largest automotive markets in this segment recorded double-digit growth: France (+47.4%), Spain (+31.5%), Germany (+22.4%), and Italy (+17.4%).

Additionally, in terms of the ranking of electric vehicle sales by model, the Tesla Model Y remains the best-selling electric vehicle in Europe, followed by models from European automakers such as BMW, Mercedes, Volvo, and Volkswagen. Chinese brands are barely represented, reflecting the negative impact of the the EU's tariff policy on Chinese electric vehicles.

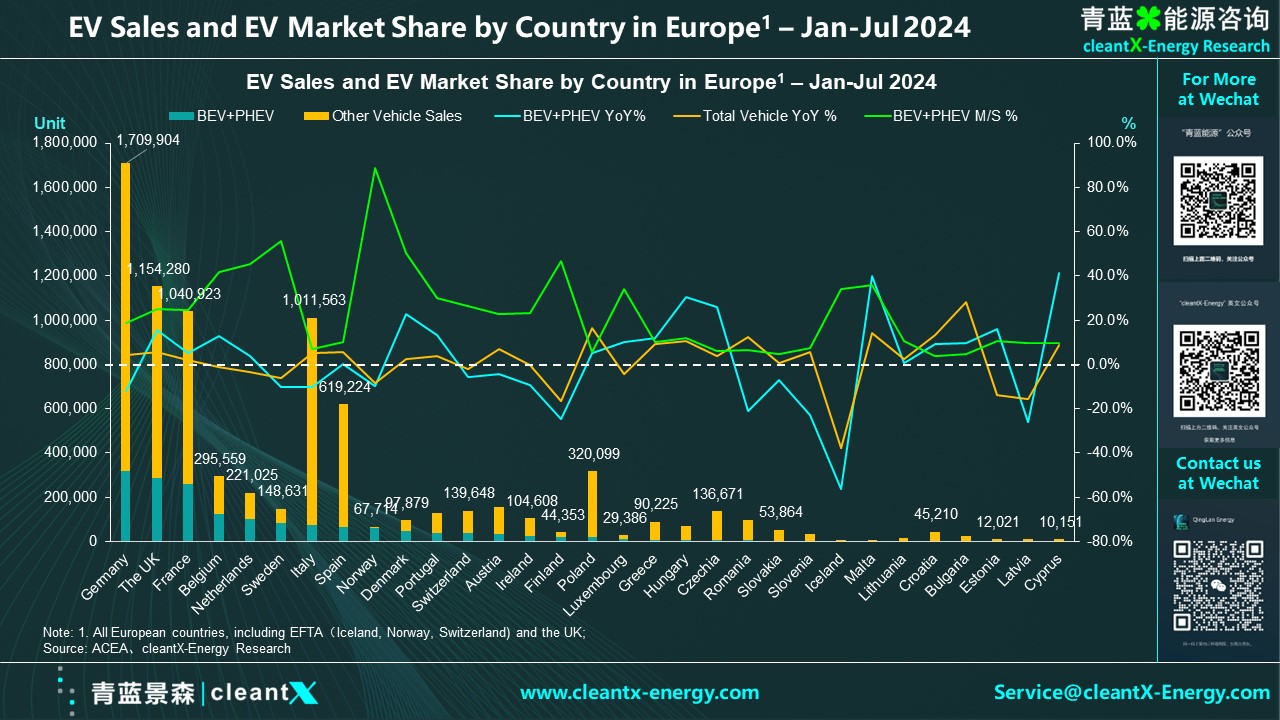

In the first seven months of 2024, the new car registration volume of all drive types in the EU increased by 3.9%, reaching 6.54 million units, with the four largest car markets—Spain (+5.6%), Italy (+5.2%), Germany (+4.3%), and France (+2.2%)—recording positive growth. Additionally, the UK, a non-EU country, also saw a 5.5% increase.

2024-11-08

2024-10-23

2024-10-22

2024-10-15

2024-10-14

Lithium-ion Battery | EV Battery Cost Down 90% in 15 Years

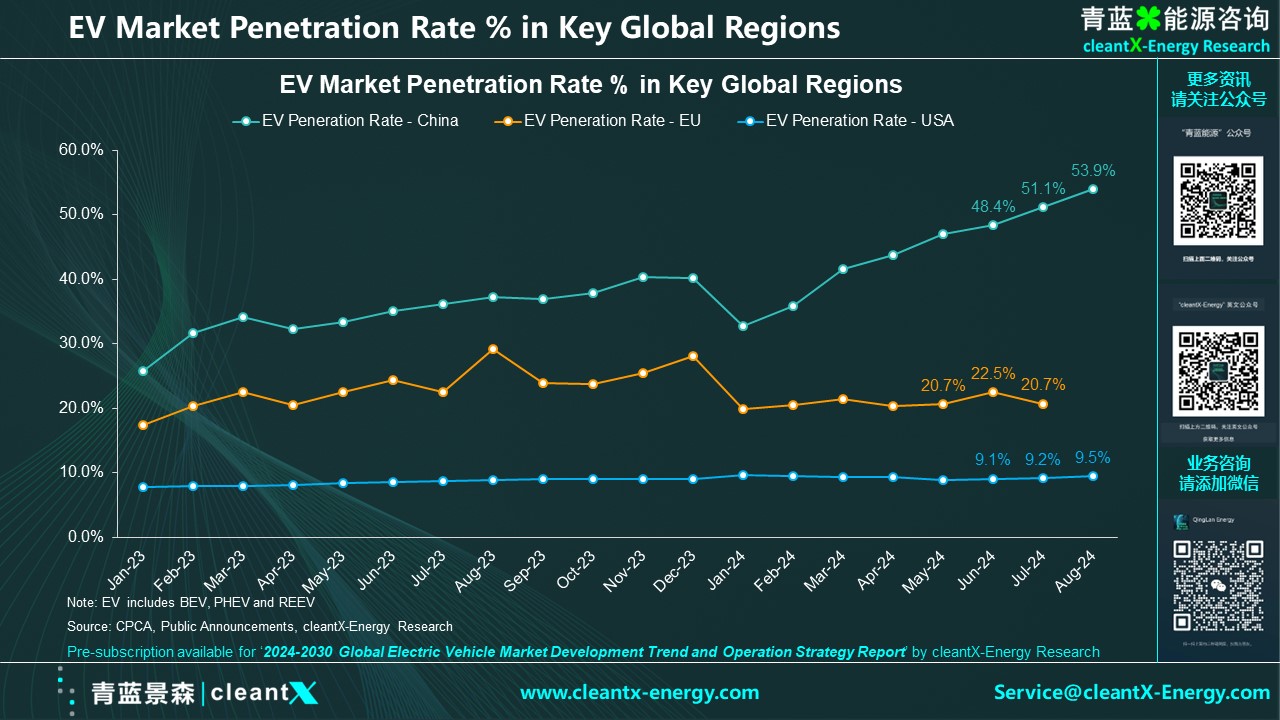

Electric Vehicle | China's EV Sales Keep Growing in August, with Market Penetration up to 53.9%

Lithium-ion Battery | Having IRA Tax Credits, The US Battery Production Cost to be Lower than China?

Electric Vehicle | Volkswagen Group's BEV Deliveries in Q3 Slide 10% Year-on-Year to 189,400 Units, but Up in China...

Electric Vehicle | China EV Sales up to 878,000 units in July 2024, with a retail penetration rate of 51.1%...

Electric Vehicle | Global EV Sales Record High in September

Electric Vehicle | EU sold 160,400 BEV and PHEV in July 2024, down 12.0% year-on-year; but HEV Sales Surge...

Electric Vehicle | EU Disclosed Duty on Chinese Electric Vehicles with Slightly Down