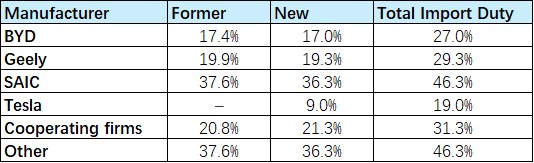

On August 20th, the European Commission published the final draft results of the anti-subsidy investigation into Chinese-produced electric vehicles, revising the punitive measures against car manufacturers. Among them, the additional tariff for BYD was slightly reduced from 17.4% to 17%; the additional tariff for Geely was reduced from 19.9% to 19.3%, and the new tariff for SAIC Motor was reduced from 37.6% to 36.3%. The tariff rate for car manufacturers who did not cooperate with the investigation remains the same.

In addition, the new tariffs that Tesla's electric vehicles exported from China to the EU will be reduced from 20.8% to 9%. BMW announced on the 21st that, according to the initial plan, the electric MINI Cooper and Aceman produced by BMW Group in China and shipped to Europe were subject to a high tariff rate of 37.6%. However, according to the final ruling published by the EU, Spotlight Automotive, the joint venture between BMW Group and Great Wall Motors, is now considered a "cooperating company" and is therefore eligible for a lower tariff of 21.3%.

According to the EU's investigation procedures, this final ruling draft will solicit opinions from relevant stakeholders of the European Commission, and then the final ruling decision will be submitted to the 27 EU member states for a collective vote. After the vote by EU countries, the final import tariffs for electric vehicles will be announced before October 30th. Once effective, the validity period will last for at least 5 years.

On the evening of August 20th, China Ministry of Commerce responded quickly, believing that there is a serious injustice in the EU's arbitration this time. The EU's anti-subsidy investigation against Chinese electric vehicles has preset conclusions, and the practices in various stages of the investigation violate the "objective, fair, non-discriminatory, transparent" principles it has committed to, and also do not comply with WTO rules, which is to engage in "unfair competition" in the name of "fair competition". China firmly opposes and is highly concerned about this.

The Ministry of Commerce pointed out that the final ruling disclosed by the EU this time did not fully absorb the opinions of the Chinese side, still adheres to the wrong approach, and imposes high tariffs, while also using sampling to treat different types of Chinese enterprises differently, distorting the results of the investigation. The EU's restrictions on Chinese electric vehicles will disrupt the stability of the global automotive industry chain and supply chain, including the EU, damage the interests of EU consumers, and undermine the EU's own green transformation and the overall situation of global cooperation in responding to climate change.

China urges the EU to take practical actions to avoid the escalation of trade frictions, otherwise, it will take all necessary measures to resolutely defend the legitimate rights and interests of Chinese enterprises.

The EU China Chamber of Commerce, China Automobile Manufacturers Association and others have also expressed strong dissatisfaction and firm opposition. Since the EU issued a temporary anti-subsidy tariff on dialogue car companies on July 4th, BYD, Geely, SAIC Motor and other companies that were inspected have also argued against the EU's anti-subsidy tariff investigation. In addition, the German Automobile Industry Association as well as BMW Group, Mercedes-Benz, Volkswagen Group and other car companies within the EU countries have also publicly expressed their hope that the EU will correct the wrong approach.

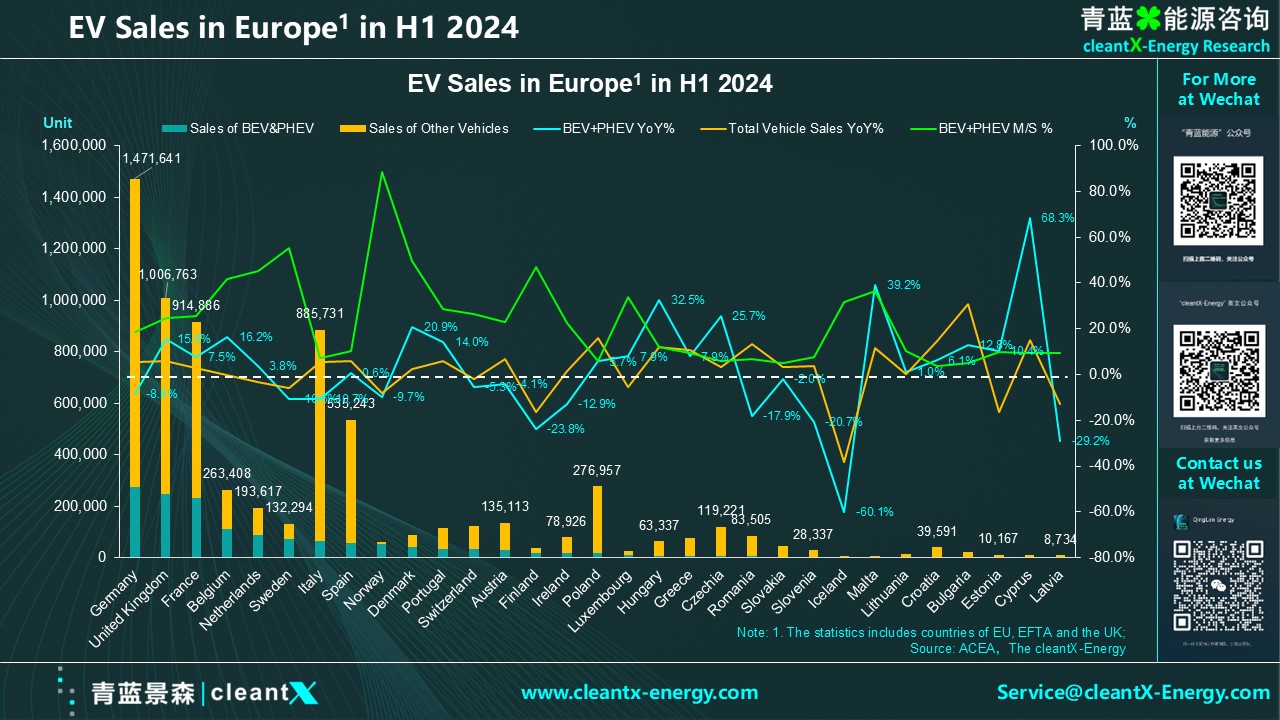

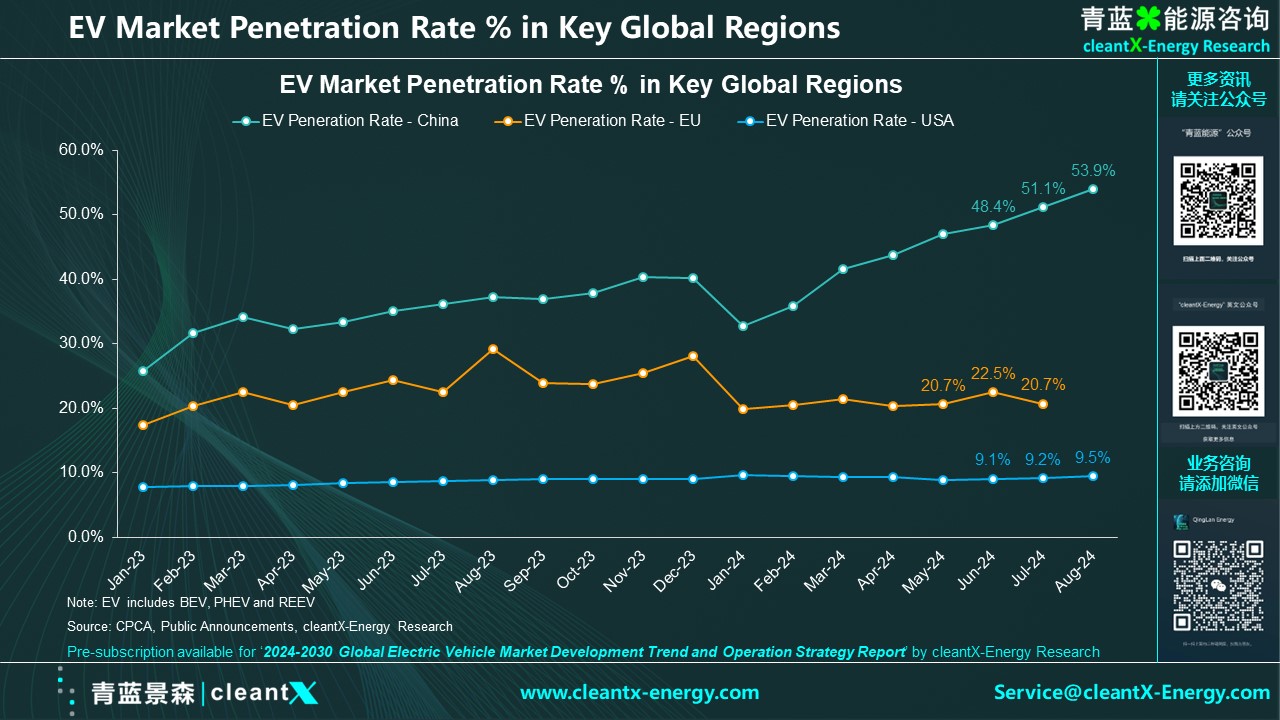

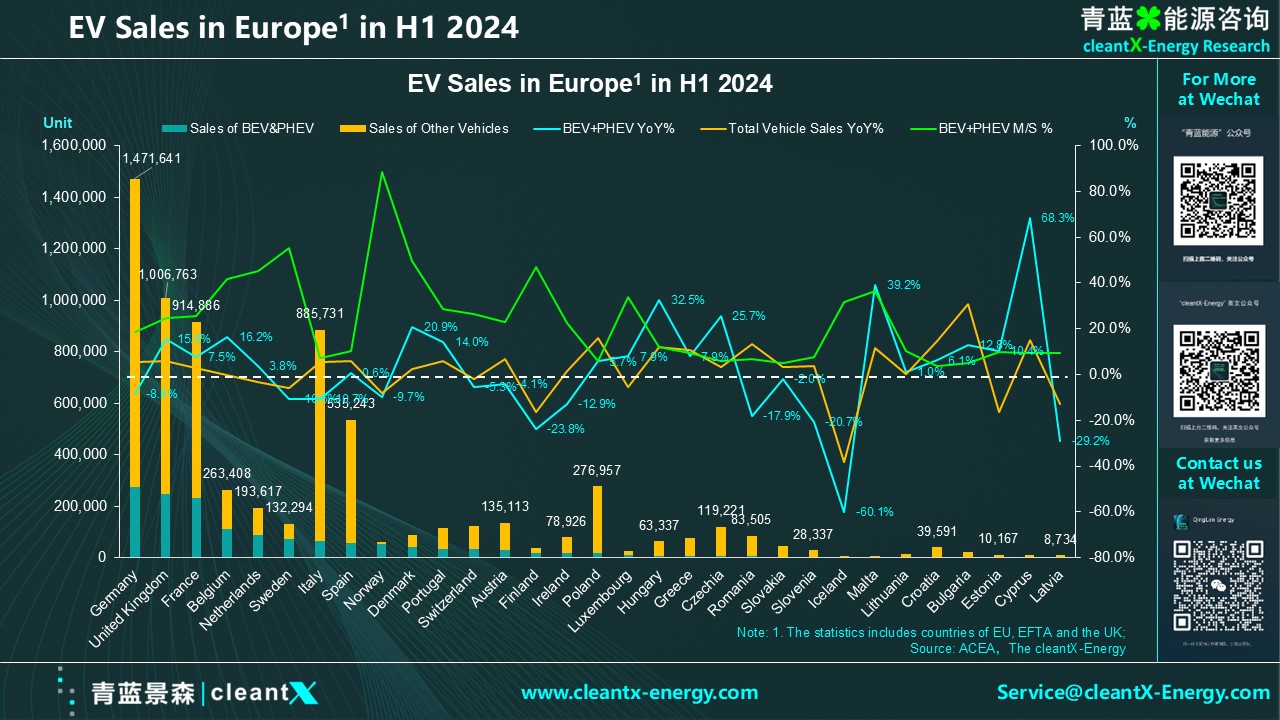

According to the statistics of AECA, in the first half of this year, the overall car market registration sales of the main European countries (including the EU, the UK, Norway, Sweden, Ireland) reached 6.88 million, a year-on-year increase of 4.4%. Among them, the total sales of pure electric (BEV) and plug-in hybrid electric vehicles (PHEV) reached 1.442 million, a slight increase of 1.6% compared to the same period last year. The proportion of electric vehicles (BEV+PHEV) in the entire car market decreased from 21.5% last year to 20.0% this year, and the market penetration rate of electric vehicles has increased instead of decreasing, showing that Europe's slow movement in electrification, energy transformation, and response to the climate change.