There is a fundamental disagreement between Trump and Biden on the development direction of the electric vehicle industry. After Trump's election, it is expected to have a series of significant impacts on the global electric vehicle industry. Trump may adjust the US climate strategy, delay the electrification transformation of the US automotive industry, and support the repatriation of the US automotive manufacturing industry by excluding China from the US automotive supply chain, increasing tariffs to hinder Chinese and European cars from entering the US market; at the same time, Trump's policies will also have a certain impact on the electric vehicle industries in Europe, Japan and South Korea.

United States: Potential Termination of Electric Vehicle Subsidies, Delaying Electrification Transformation

Trump may terminate the IRA (Inflation Reduction Act) subsidies for the electric vehicle industry, cut or cancel federal government incentives for purchasing electric vehicles, and instead vigorously support the traditional fuel vehicle industry in the US. This will pose a challenge to the electrification transformation of the US and even the global automotive industry.

Previously, the Biden administration provided subsidies and tax incentives worth $369 billion for electric vehicles and green technologies such as batteries through policies such as the Bipartisan Infrastructure Bill and the Inflation Reduction Act, promoting the development of the US electric vehicle manufacturing industry, and planned to make electric vehicle sales in the US account for 50% of total passenger car sales by 2030. Trump, on the other hand, has always publicly opposed clean energy, criticized the Bipartisan Infrastructure Bill, hoped to repeal the Inflation Reduction Act, and increase US oil and natural gas production.

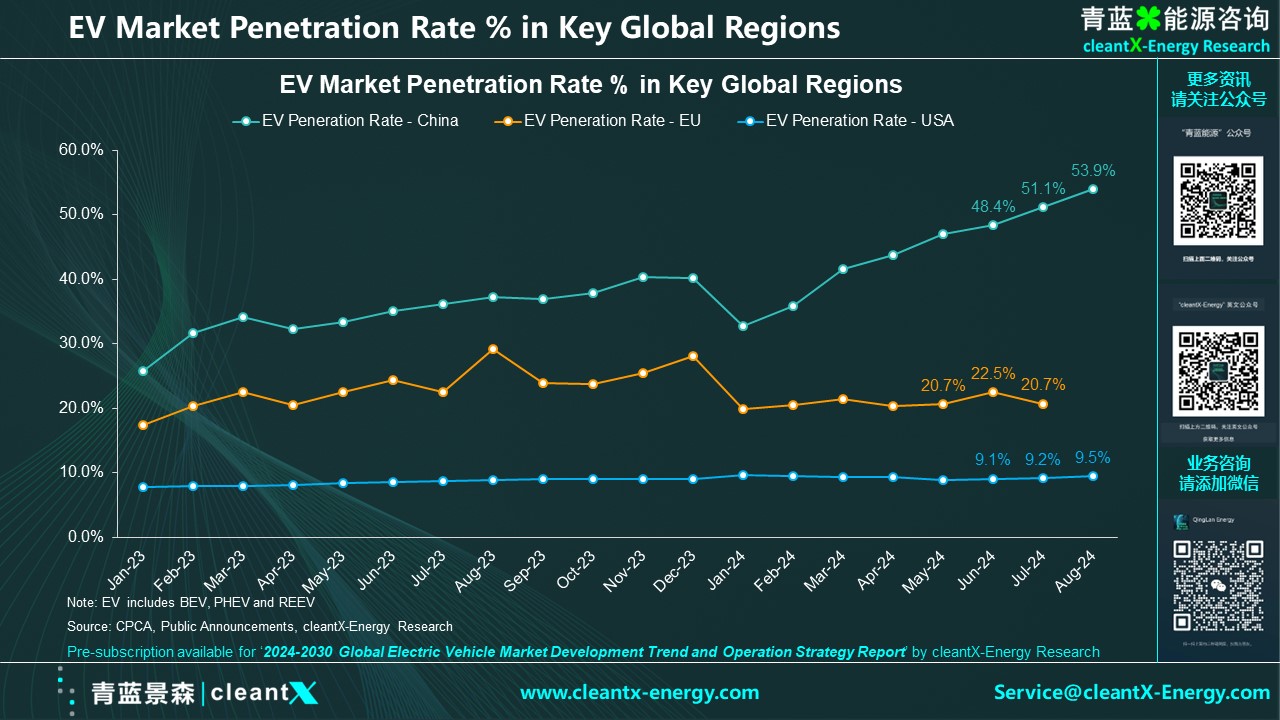

This year, the demand for electric vehicles in the US market has cooled down, and General Motors and Ford have also slowed down the pace of electrification transformation. If Trump abolishes the relevant support and preferential policies, the resources and investment of US car companies in the field of electric vehicles will further decrease, thereby further slowing down the US electric vehicle market.

However, since Musk is the most powerful supporter of Trump's election as president, it is not ruled out that after Trump takes office, in addition to SpaceX and X.AI, Trump will also give Musk certain policy preferences in the fields of electric vehicles, 4680 batteries, and unmanned autonomous driving Robotaxi. The 13% surge in Tesla's stock price on November 6 is a good reflection of this.

China: Potential Comprehensive Suppression from the US, and Higher EV Tariffs to the US

After Trump takes office, he will largely continue the Biden administration's previous suppression policies against China's electric vehicle and EV battery related industries, and continue to promote US trade protectionism policies.

Since last year, the Biden administration has managed to exclude Chinese batteries and key minerals and other advantageous products from the US supply chain via policies of IRA and FEOC.

In September this year, the Biden administration announced that on the basis of the original additional tariffs on China under the Section 301, it will further increase tariffs on Chinese imported electric vehicles, lithium-ion batteries, photovoltaic cells, key minerals, semiconductors, port cranes, and other products. The tariff on electric vehicles has been increased from 25% to 100%, plus the previous 2.5% regular tariff, and Chinese electric vehicles exported to the US will have to pay a tariff as high as 102.5%. In addition, the Biden administration has also taken a series of measures to restrict the use of Chinese smart vehicles in the US, and the blockade of the chip industry has also had a chain reaction in China's smart car industry.

After Trump's administration, it is highly likely to continue the previous relevant policies of the Biden administration and continue the tariff strategy of 2018, and introduce a series of restrictive measures on Chinese products including automobiles.

Trump once publicly stated that he would impose a tariff of 200% or even 1000% on cars produced in China, and threatened to impose a tariff of more than 200% on Chinese vehicles imported from Mexico, as Trump claimed that the tax rate he sets will definitely make it impossible for cars imported from China or Mexico to be sold in the United States. “I don't want these imported vehicles to damage the interests of American car companies."

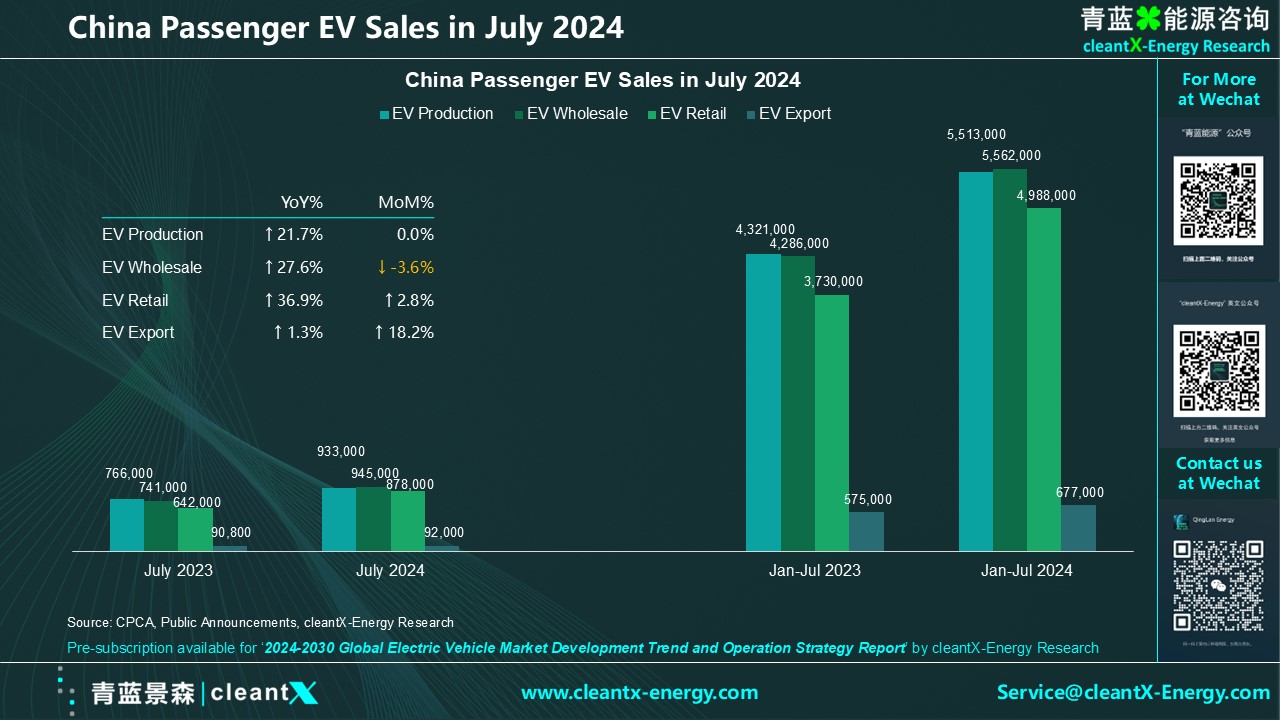

Imposing tariffs on Chinese electric vehicles will further reduce China's export of electric vehicles to the US. However, the proportion of China's export of electric vehicles to the US is originally very low. According to Chinese customs data, the total export volume of electric vehicles from China to the US in 2023 is only about 12,500 vehicles, accounting for merely 0.3% of the total car export volume, and the main exporters are Tesla Shanghai factory and other American car companies. Due to the restrictions of European and American markets on Chinese electric vehicles, Chinese car companies have turned their attention more to other emerging markets.

The potential high tariffs imposed by the US on Chinese electric vehicles produced in Mexico will also hinder the model of China entering the US market through Mexico. However, Mexico is also a manufacturing base for European and American cars. According to statistics, Mexico exported about 3 million vehicles to the US in 2023. Among them, the three Detroit-based OEMs accounted for half of the market share. Mexico is also the main manufacturing center for European car companies such as Volkswagen, BMW, and Audi, and the vehicles produced are mainly aimed at the US market. If the US imposes additional tariffs on cars produced in Mexico, it will also have an adverse effect on European and American car companies.

In addition, since Trump's strategy is to attract foreign car companies to invest in the US through tax incentives, reduce energy costs, and release regulatory burdens, in order to promote the return of American manufacturing and solve local employment problems, these policies may attract Chinese companies to build factories in the US. Trump is also open to Chinese car manufacturers building factories in the US and has publicly stated on multiple occasions that he is willing to invite Chinese car companies to build factories in the US. However, due to the US's continued adoption of decoupling and investment review policies against China, it is expected that Chinese car companies will still face greater uncertainty in investing in the US. Previously, Chinese battery company CATL cooperated with American electric vehicle companies such as Ford, General Motors, and Tesla through the LSR (License Royalty Service) model. It is not ruled out that other Chinese battery companies will continue to cooperate with American companies in this model in the future.

Europe, Japan and South Korea: Potential Higher Tariffs to the US and Affected by Slowdown of EV Transformation

Trump may impose additional tariffs on cars and related products in Europe and other regions to reduce the trade deficit. On October 15, Trump said in a speech in Chicago that if he is elected again, he will also impose high tariffs on European imported cars to force car manufacturing back to the US. Trump also specifically mentioned that Mercedes-Benz's production activities in the US are just assembly work, and such a production model is unfair to American workers.

At present, the US imposes a 2.5% tariff on vehicles imported from the EU, but the US imposes a 25% tariff on light trucks and pickup trucks, while the EU imposes a 10% tariff on cars imported from the US.

Morgan Stanley recently released a research report saying that after Trump takes office, it is very likely that the US will increase vehicle import tariffs from the EU, and German car companies will be the most affected. Currently, Mercedes-Benz and BMW account for about 8% of their total sales in the US with vehicles produced and sold in Europe, and Volkswagen Group accounts for 3%, but Volkswagen Group's "cash cow" Porsche all sells vehicles produced in European factories in the US, and this part of the sales accounts for 25% of Porsche's total sales. The study speculates that European high-end SUVs and sedans exported to the US are likely to become the main targets of US tariff increases.

Changes in US-EU tariffs may force European car companies represented by BMW, Audi, Mercedes-Benz, and Porsche to build factories in the US to avoid the impact of tariffs. At the same time, Trump's negative policy on electric vehicles will also increase the difficulty of European car companies' electric transformation in the US market, which may lead some European car companies dedicated to EV transformation to increase investment in China to enhance their competitiveness.

Japanese car manufacturers will also be impacted. The significant depreciation of the yen and the huge sales volume of Japanese cars in the US market are important reasons why Japanese car companies can still maintain high sales and profits. According to public data, in 2023, the overall market share of Japanese car companies in the US reached 35.5%, second only to the 43.5% of American car companies. If Trump forces the yen to appreciate, it will seriously affect the sales competitiveness and profits of Japanese cars in the US, and may also force Japanese car companies to tilt more resources to other markets including China.

South Korean battery manufacturers may face new challenges. Due to the high barriers set by the US market for Chinese-produced electric vehicles and batteries, the three major South Korean battery manufacturers currently have a unique advantage in the North American market. However, Trump has threatened to impose tariffs on South Korean cars and parts, and if Trump abolishes subsidies for the electric vehicle industry, the performance of related South Korean companies will be greatly affected.

In summary, after Trump's inauguration, he will have a multifaceted impact on the global automotive industry, particularly on the competition between the automotive industries of China and the US, tariff trade policies, the development of electric vehicles, and the reshaping of the global automotive supply chain, while continuing to maintain the multidimensional competitive landscape of the global automotive industry among China, North America, Europe, Japan and South Korea.