According to statistics from the China Energy Storage Association of the China Industrial Association of Power Sources (CIAPS-CESA), in July 2024, China saw 101 grid-connected new energy storage projects put into operation, with a total scale exceeding 3GW, reaching 3.248GW / 8.429GWh. This represents a 43.7% decrease compared to June, but an 85.78% increase year-over-year.

Looking at the new types of energy storage technologies, the lithium iron phosphate energy storage market continues to lead the pack. Additionally, four flow battery energy storage projects and one sodium-salt battery energy storage project were launched, indicating a positive trend.

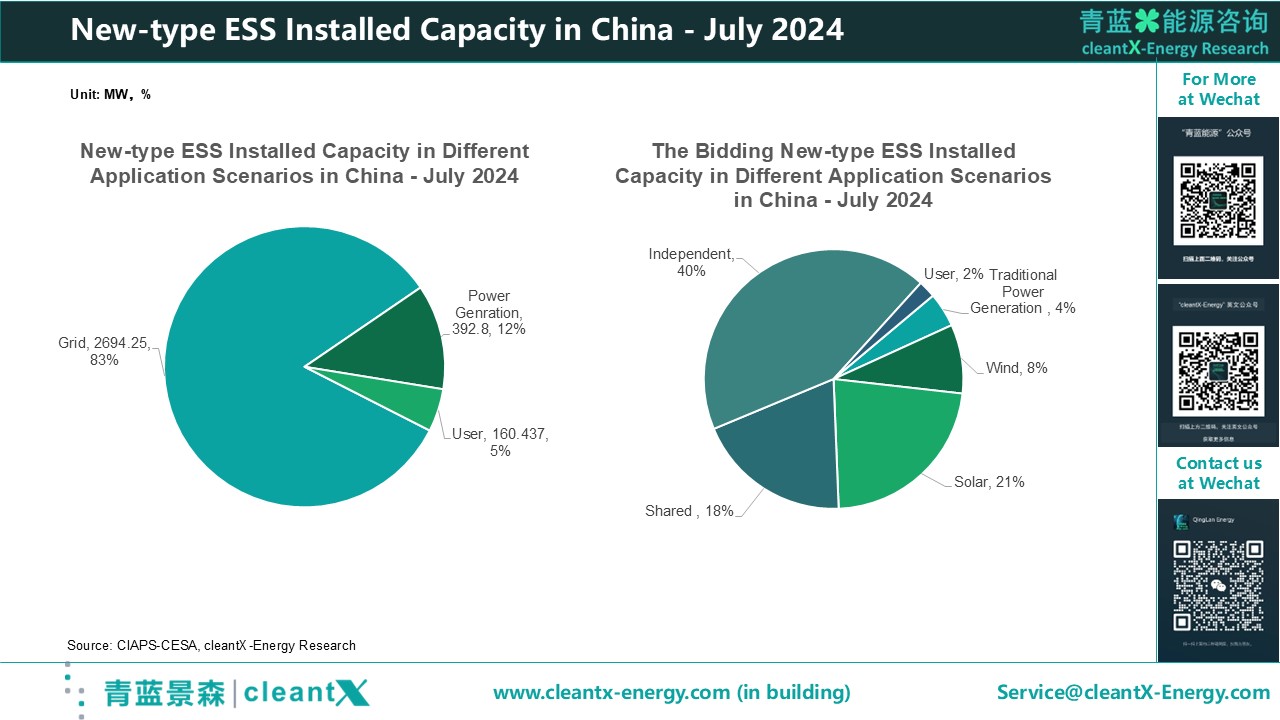

In terms of new energy storage application scenarios, the number and scale of user-side energy storage projects doubled compared to June, with a total of 69 user-side energy storage projects launched, mainly concentrated in Zhejiang, Jiangsu, and Guangdong provinces, with a total scale of 160.437MW/308.758MWh. The scale of grid-side energy storage projects launched was less than in June, with a total of 25 grid-side energy storage projects launched, with a total scale of 2.694GW/6.795GWh. There were a total of 7 power source-side energy storage projects, with a total scale of 392.8MW/1325.6MWh, primarily photovoltaic-storage projects.

According to incomplete statistics, in June, there were a total of 72 energy storage projects with bids won and candidates announced, including energy storage EPC, energy storage PC, energy storage equipment, energy storage system procurement, and centralized procurement, with a total scale reaching 8.023GW/19.419GWh.

Looking at the application scenarios of the winning projects, grid-side energy storage projects (including independent and shared energy storage) have the highest proportion of bid package capacity, accounting for 58%, with winning unit prices ranging from 0.531 to 1.79 yuan/Wh, and a weighted average price of 1.1445 yuan/Wh; new energy storage projects account for 36%, with winning unit prices concentrated between 0.435 and 0.978 yuan/Wh, and a weighted average price of 0.525 yuan/Wh; user-side energy storage projects have winning unit prices mostly concentrated above 1 yuan/Wh, with a weighted average price of 1.323 yuan/Wh.